This content originally appeared on Level Up Coding - Medium and was authored by Jon Gulson

Commercially, “long tail” is a generalised description for content or product in low demand, sales, and volume, which collectively constitutes a market share exceeding the combined top segment. This means a larger proportion of population rests within a long tail of probability distribution, rather than the concentrated segment which might be considered more representative of that market.

This can be related to bitcoin — the totality of the proposition (the coin), is derived from its constituent parts (the bits). In his description of combining and splitting value, Satoshi Nakamoto phrases this as avoiding the problem of “fan-out”:

“It should be noted that fan-out, where a transaction depends on several transactions, and those transactions depend on many more, is not a problem here. There is never the need to extract a complete standalone copy of a transaction’s history.” Bitcoin: A Peer-to-Peer Electronic Cash System, 2008

To form a picture in understanding, think of the tail as a chain and vice-versa, so bitcoin becomes an entity analogous to legal personhood:

“Although it would be possible to handle coins individually, it would be unwieldy to make a separate transaction for every cent in a transfer. To allow value to be split and combined, transactions contain multiple inputs and outputs. Normally there will be either a single input from a larger previous transaction or multiple inputs combining smaller amounts, and at most two outputs: one for the payment, and one returning the change, if any, back to the sender.” Bitcoin: A Peer-to-Peer Electronic Cash System, 2008

The expectation in money

Once game theory had rendered human economic interaction a strategic proposition, the mathematician had to do little more than resolve the strategy as deterministic: while von Neumann and Morgenstern established the strategy summed to zero, it wasn’t until John F Nash Jr.’s The Bargaining Problem (1950) that the optimal move in a game could sum from zero and still make sense.

Nash worked from the premises of rationality, contingency, certainty, and probability:

The idea of money as a utility in the bargain continued to be developed by Nash in later life, where (Nash) expressed distrust of central banks, because of the way they conditioned expectation:

Nash criticised central banks due to insufficient axioms in addressing the users of their currency:

In this respect, Nash also criticised the central bank characteristic of “inflation targeting” because a natural target number didn’t define its premise, and that if such a characteristic were to be accepted, any number other than zero (in targeting inflation) is arbitrary:

This idea is echoed by Satoshi Nakamoto in describing bitcoin:

“Bitcoin is a digital currency using cryptography and a distributed network to replace the need for a trusted central server. Escape the arbitrary inflation risk of centrally managed currencies!” Satoshi Nakamoto, 6 July, 2010

Satoshi is further redolent of Nash’s The Bargaining Problem (1950), by using probability to arrive at an intuition as to the value of bitcoin:

“A rational market price for something that is expected to increase in value will already reflect the present value of the expected future increases. In your head, you do a probability estimate balancing the odds that it keeps increasing.” Satoshi Nakamoto, 21 February, 2010

Bitcoin by design

Satoshi described himself as more a designer than coder — with bitcoin a design where “the majority version wins” — explaining the long tail affect in reference to bitcoin generation:

“According to the “long tail” theory, the small, medium and merely large farms put together should add up to a lot more than the biggest zombie farm.” Satoshi Nakamoto, 3 November, 2008

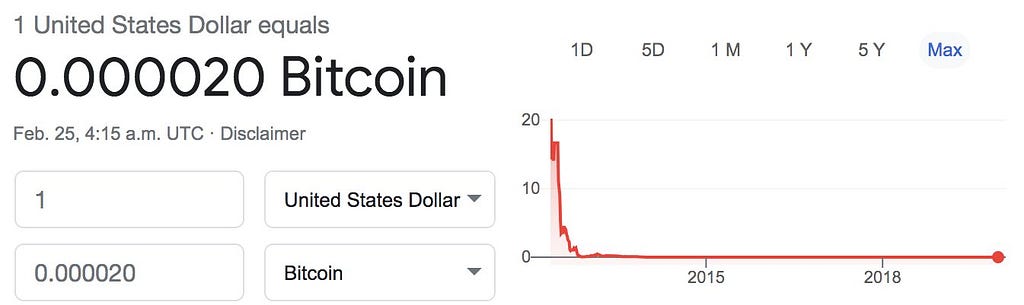

In respect to the “arbitrary” nature of inflation targeting, the long tail affect on sovereign issuance is demonstrable:

And insight to bitcoin design parameters is interesting, because Satoshi debunks the energy myth surrounding bitcoin (and after saying he didn’t wish to taunt governments by telling them bitcoin was outside their reach):

“It’s not stable-with-respect-to-energy. There was a discussion on this. It’s not tied to the cost of energy.” Satoshi Nakamoto, 5 July, 2010

Signatures in representation

After over a decade working on The Ideal Money, John F Nash Jr., observes again on the nature of inflation and this time in relation to a game of signatures:

“I feel that the sort of authority or agency that would be able to establish any version of ideal money (money intrinsically not subject to inflation) would be necessarily comparable to classical “Sovereigns” or “Seigneurs” who have provided practical media for use in traders’ exchanges”. John F Nash Jr., Ideal Money, 2011

“it is as if there is another player in the game of the contract signers and this player is the Sovereign who provides the medium of currency in terms of which the contract is to be expressed.” John F Nash Jr., Ideal Money, 2011

Satoshi speaks to the possibility of gradually transitioning from bitcoin, in respect to the possibility of a “stronger signature”, as if better representation became possible (comparable to attorney grade quality being determined by contract writing ability to which the majority can trust):

“if it happens gradually, we can still transition to something stronger. When you run the upgraded software for the first time, it would re-sign all your money with the new stronger signature algorithm. (by creating a transaction sending the money to yourself with the stronger sig)” Satoshi Nakamoto, 10 July, 2010

For the designer, the software will only recognise the most proof of worked chain — the “majority” — but for the bitcoin designer, it can never replace the human word in even the most distant parts of the tail.

Long tail distribution is a bitcoin design decision was originally published in Level Up Coding on Medium, where people are continuing the conversation by highlighting and responding to this story.

This content originally appeared on Level Up Coding - Medium and was authored by Jon Gulson

Jon Gulson | Sciencx (2021-03-05T13:17:41+00:00) Long tail distribution is a bitcoin design decision. Retrieved from https://www.scien.cx/2021/03/05/long-tail-distribution-is-a-bitcoin-design-decision/

Please log in to upload a file.

There are no updates yet.

Click the Upload button above to add an update.