This content originally appeared on DEV Community and was authored by Radin Dev

We are all familiar with the banking facility system and its ups and downs, and we know the inconveniences of borrowing from banks. But in today's world, where blockchain technology and digital currencies are available; It is a bit strange to stay behind the barrier of centralized systems such as banks. Because you can quickly get a loan using the Crypto Lending system, away from time-consuming administrative processes and in the shortest time.

Getting a loan in the cryptocurrency world is much easier and faster than getting a bank loan, and these days it has many fans around the world. This article will take a closer look at digital currency loans and how to get them; Stay with us.

How does a cryptocurrency lending system work?

To get a digital currency loan, you pledge your cryptocurrency assets (Bitcoin, Ethereum, Tether and other cryptocurrencies) and borrow from other users' assets (the loan can be Bitcoin, Ethereum, Tether, etc.).

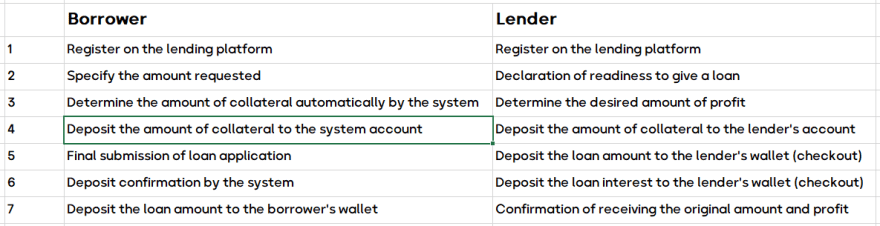

This process is done on a peer-to-peer (P2P) basis in the context of online crypto lending platforms, and there are no intermediaries. At the time of settlement, the borrower, in addition to the loan amount, must also deposit the amount of interest determined at the time of signing the contract to the lender's account.

Why and when will you need a digital currency loan?

Imagine that you bought some cryptocurrencies for investment purposes and did not intend to sell them. But after this investment, you will need financial support. In this situation, you should convert your cryptocurrencies into Fiat currency and stop investing. But the second way is to use a crypto lending system. This way, you can meet your financial needs without losing your cryptocurrency.

Who lends you?

The lenders of this system are usually people who have bought some cryptocurrencies for investment and earn money from their capital by lending their digital currency assets and receiving interest on it.

What is the guarantee that you will repay the loan?

The amount you deposit as collateral is generally many times the amount of the loan you have received; Transferred to the lender's account. If you refuse to pay interest and principal on the cryptocurrencies, the collateral will remain in his account, and you will no longer have access to your cryptocurrency assets. (The lender will not sell this asset, and only the amount in his account will be blocked until the loan is fully settled).

Differences between crypto lending system and bank loans

When you are planning to borrow from a bank, the first step is to provide accurate identification and authentication documents at the bank. However, to get a cryptocurrency loan, there is no need to identify and present identification documents.

Banks will ask you for guarantees such as a house deed or a valid payslip, and you will not be given a loan without such collateral. But in crypto lending, you can easily use your cryptographic assets as collateral.

Banks do not provide facilities to people under 18 and do not have a fixed job with a certain amount of income. But there are no restrictions on getting a crypto loan, and anyone with a cryptocurrency can use the network's loans.

When you borrow from banks, you have to wait for the money to be credited to your account for a while. But in the crypto lending system, the loan amount will be credited to your wallet account when the contract is approved.

What are the benefits of using a crypto lending system?

Digital currency lending is more practical. This means that you do not need to explain why you apply for a loan and only use this amount in the same field.

The amount of the crypto loan is determined according to the specified collateral and is not related to the borrower's transactions and payments.

No long-term investment is required to earn crypto loans.

Due to the universality of blockchains, crypto lending knows no boundaries and geography and can be contacted or borrowed from anywhere in the world.

Changing tax trends is another benefit of cryptocurrencies. The amount received and repaid by the borrower is not recorded in any centralized financial center, which exempts him from being held accountable to the tax authorities for the loan he has taken out.

Determining the loan amount by the borrower and the lack of restrictions on the requested amount are other features of the crypto loan.

What are the disadvantages of using a crypto lending system?

Like all other digital systems, the crypto lending system has drawbacks and can cause problems for those who use it.

The first thing that might be a problem for the borrower or lender in this system is the error in the writing code of the smart contract. Crypto lending is done through smart contracts, and if there is the slightest mistake in its coding, the parties will suffer irreparable losses.

Another problem is the heavy collateral that the system imposes on the borrower. When receiving a loan from a bank, the guarantee is usually not several times the requested loan amount and determines the amount and amount of collateral according to the facility's conditions. But online digital currency loan platforms specify a large amount as collateral, sometimes several times the amount of the loan received.

The main reason for the heavy collateral is the numerous fluctuations in the cryptocurrency market. The system plans to receive collateral so that if the value of the cryptocurrency to be used as collateral drops sharply, it will still be worth more than or equal to the loan received. However, if the amount of depreciation of the collateral reaches such a level that it is less than the loan amount; The system automatically auctions the collateral to make up for its loss.

This is called the liquidation or liquidation of Cryptocurrency assets, an infrequent but possible occurrence in the crypto lending system. The borrower, in this case, must increase the collateral of the loan immediately before the liquidation of his property. Another way is to get a quick loan settlement in such a situation.

Steps to get a digital currency loan

Crypto lending platforms:

- MakerDAO Lending Platform

- Compound Lending Platform

- Aave Lending Platform

- DYdX Lending Platform

Centralized crypto lending systems

In addition to defaults or decentralized systems, some organizations and companies provide cryptocurrencies to applicants with different rules. The loan applicant in this system, unlike decentralized systems, must be authenticated and a person known to the collection. These institutions generally use a marginal lending system; In most cases, they provide such services to launch various projects and thus participate in new projects.

Binance Digital Currency Exchange, Hodlnaut Lending Platform, BlockFi Lending Platform, Celsius Lending Platform and Nexo Lending Platform; some centralized systems are managed completely and now also provide digital currency loans.

Concluding remarks

Finally, note that crypto lending systems, like all services based on Defi or decentralized financial platforms, are based on blockchain technology; It requires sufficient knowledge and awareness in this field. Making a digital currency loan, like investing in this market or trading and earning money, must be done with enough expertise and great care. Because, as you know, no contract can be deleted or changed after concluding a blockchain platform, and you will not have a way back in case of the slightest mistake.

This content originally appeared on DEV Community and was authored by Radin Dev

Radin Dev | Sciencx (2021-07-13T07:17:59+00:00) What is Crypto Lending and what are the benefits?. Retrieved from https://www.scien.cx/2021/07/13/what-is-crypto-lending-and-what-are-the-benefits/

Please log in to upload a file.

There are no updates yet.

Click the Upload button above to add an update.