This content originally appeared on Level Up Coding - Medium and was authored by Dmytro Spilka

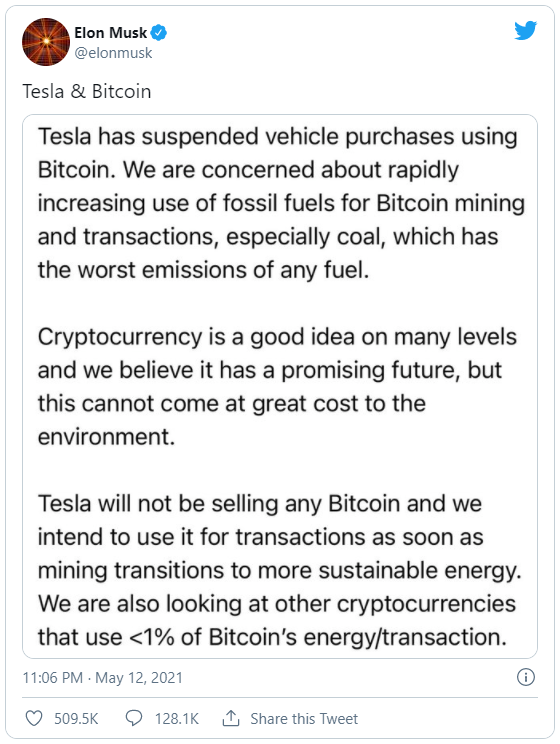

2021 has been a tumultuous year so far for Bitcoin and the wider cryptocurrency landscape. After entering January in the midst of regular new all-time highs, welcoming $1.5 billion in investment from Tesla and gaining new levels of adoption around the world, Q2 has seen aggressive pullbacks that have wiped much of the cryptocurrency’s value off the market. In a collapse that appeared to begin with an Elon Musk tweet regarding the carbon footprint of Bitcoin, could the world’s most famous cryptocurrency come undone in a sustainability-focused investing landscape?

The power of social media can be scary — especially for cryptocurrency markets that are heavily influenced by speculation and sentiment.

(Image: BBC)

When Elon Musk announced that his company, Tesla, would suspend purchases of its vehicle using Bitcoin, the impact was far reaching. Despite Musk later confirming that Tesla’s investments in the cryptocurrency were still in place, the value of BTC — compounded by tightening regulations in China — plummeted.

(Image: CoinGecko)

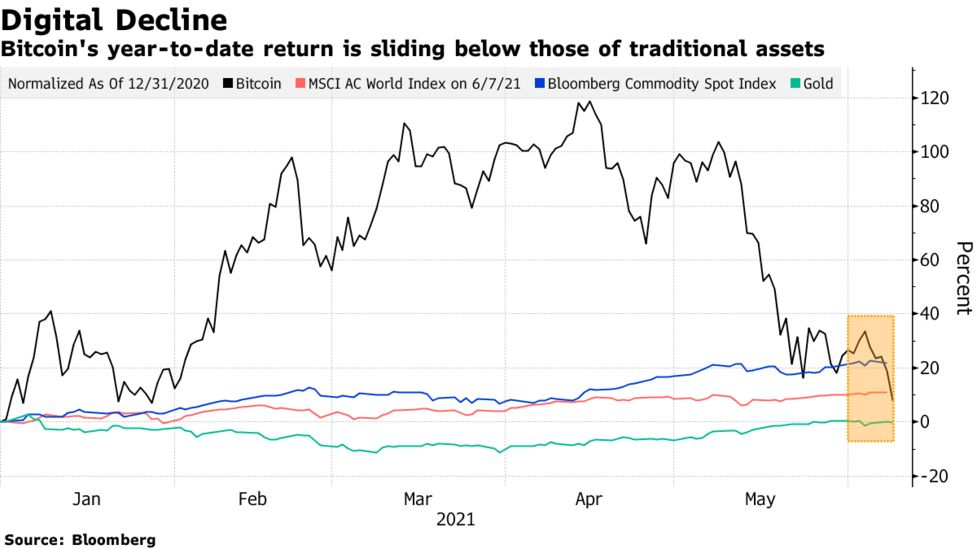

In the month that followed, Bitcoin fell 45.2% — undoing much of the coin’s price accumulation that occurred throughout January and February of 2021 in the process.

(Image: Bloomberg)

To further compound Bitcoin’s problems, the coin is now underperforming in terms of yearly return when compared to some traditional assets — an unusual occurrence one year on from the cryptocurrency’s halving event.

However, Elon Musk’s tweet regarding Bitcoin’s sustainability has raised a brand new level of concern over the sustainability of the cryptocurrency. Whilst Bitcoin shed 45% of its value in a month, more sustainability-focused cryptocurrencies like Cardano (ADA) fell by only 8.6% — largely due to the sheer level of market dominance that BTC dictates.

The Cost of Rising Carbon Emissions

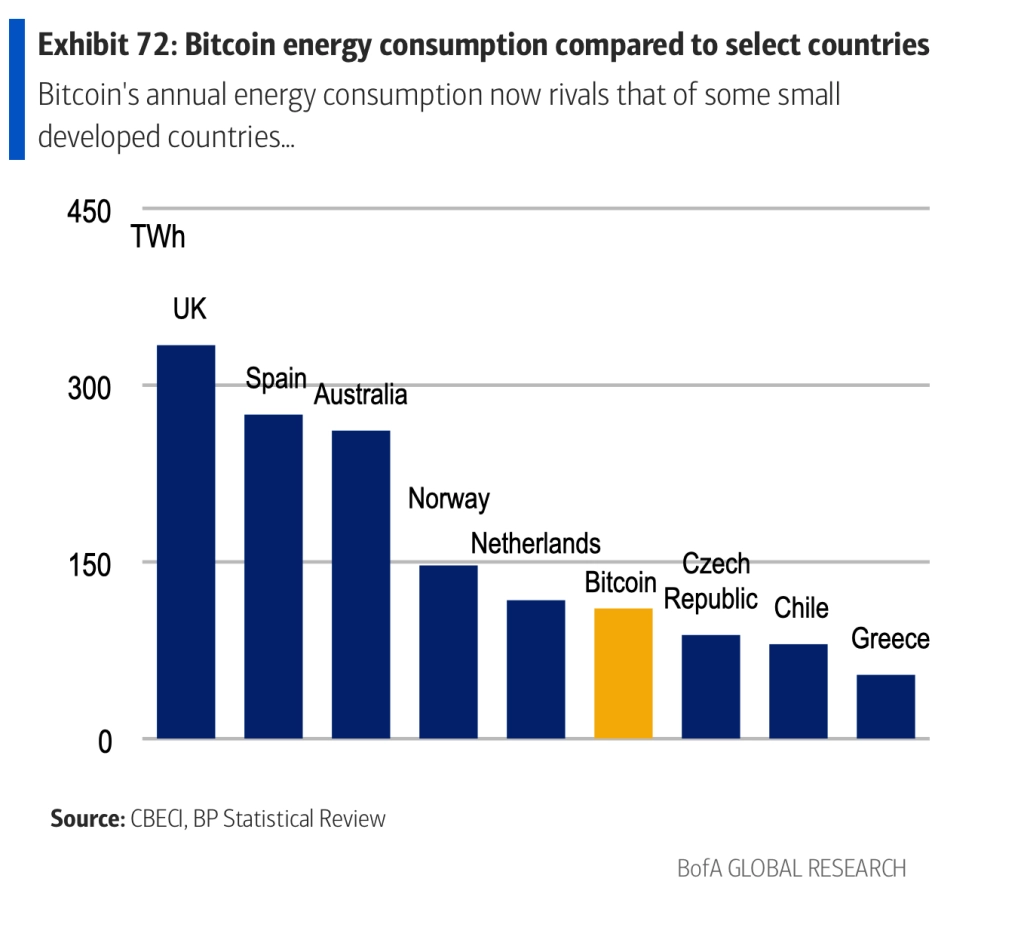

As Bitcoin’s price rallied in 2021, a Bank of America report set out to better understand the coin’s impact on the environment. Wall Street appears to agree that there’s plenty of evidence that suggests Bitcoin mining carries a profoundly negative impact on the environment, but just how bad have things become?

According to the BofA report, Bitcoin’s recent price surges have led to an ‘astronomical’ rise in carbon emissions linked to the coin. Over the past two years, the rise of BTC has led to an increase to associated emissions by over 40 million tonnes — which equates to 8.9 million extra cars on the road.

(Image: Fortune)

According to the report, Bitcoin’s energy consumption has surpassed the total emissions of developed nations like Greece, Chile and Czech Republic.

The Rise of Sustainable Investments

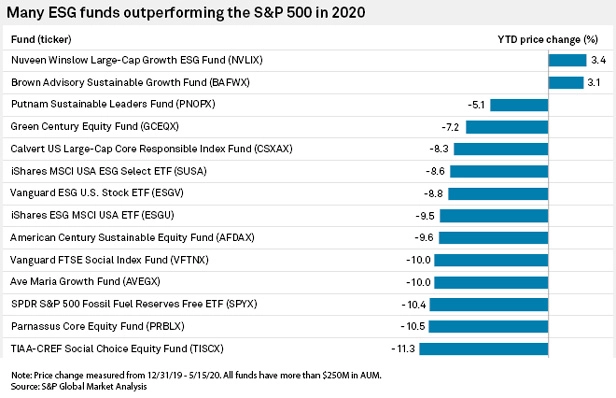

Sustainable investments and ESG stocks have become a big deal in the wake of the COVID-19 pandemic — and rightly so.

Consumers are actively looking for more sustainable products and services as a whole, while rewarding environmentally-friendly businesses more since the arrival of the health crisis, according to findings from E.ON.

Data shows that as much as 36% of UK residents are consciously buying products from companies that have strong environmental credentials. Meanwhile, 80% claim to be planning to purchase goods and services from businesses that have evidently sought to be environmentally friendly.

The pandemic has helped to raise more concerns regarding the climate crisis from consumers and investors alike, and this movement has helped to facilitate a much greater emphasis on the carbon footprint of companies.

E.ON’s Renewable Returns Report explores the potential for a green economic recovery following the pandemic, and the research appears to point to a widespread effort to care more for the environment.

Of the consumers surveyed in the report, some 72% claim to pay attention to whether a business acts in a climate-friendly manner, while 65% believe that it’s important that the products or services they buy don’t cause damage to the environment.

(Image: Think Advisor)

As the data above shows, this sentiment has already begun to spill into the world of investing, with ESG (environmental, social and governance) funds outperforming the S&P 500 during the height of the pandemic.

This has also led to a rise in sustainable companies winning new investment on public markets. Recently, OAT-LY, a sustainable drinks company, debuted on the New York Stock Exchange with a $13 billion valuation. Other late, other companies are looking to get in on the action to accommodate this new wave of investor sentiment.

We only have to look at the world of eyewear to see the value that sustainability holds. With some 75% of the adults are in need of some form of vision correction treatment, Christopher Cloos’ collaboration with NFL star Tom Brady to promote a new range of biodegradable sunglasses shows that market pulling power lies firmly in the hands of sustainable products.

Can Bitcoin Become Sustainable?

Efforts to make Bitcoin more sustainable are underway in a move that could help to safeguard the future of the digital asset and the environment as a whole. In March, Norway’s second-richest person, Kjell Inge Røkke, an oilfield services billionaire, launched Seetee — a company that aims to “establish mining operations that transfer stranded or intermittent electricity without stable demand locally — wind, solar, hydro power — to economic assets that can be used anywhere.” Røkke makes the claim that Bitcoin is “a load-balancing economic battery, and batteries are essential to the energy transition required to reach the targets of the Paris Agreement.”

Røkke isn’t alone in his bid to make the mining of Bitcoin a more sustainable act, but it can be a difficult task to bring environmental friendliness to a process that requires a significant amount of energy around the clock.

As Bitcoin’s carbon footprint continues to rise whenever its price surges, this recent correction may be an ideal time for the cryptocurrency landscape to sit up and take stock of its functions. The future certainly remains bright for the world of cryptocurrencies, and although inefficient assets like Bitcoin are in the midst of turbulent times, the coin’s recent surges have won over new admirers. If the next innovation surrounding the cryptocurrency can work to limit its sprawling carbon footprint, we could see a resounding return for the bull market that dominated late 2020 and early 2021.

Bitcoin’s Disastrous Few Months Show that Sustainability is the World’s Most Sought After Asset was originally published in Level Up Coding on Medium, where people are continuing the conversation by highlighting and responding to this story.

This content originally appeared on Level Up Coding - Medium and was authored by Dmytro Spilka

Dmytro Spilka | Sciencx (2021-07-20T15:29:15+00:00) Bitcoin’s Disastrous Few Months Show that Sustainability is the World’s Most Sought After Asset. Retrieved from https://www.scien.cx/2021/07/20/bitcoins-disastrous-few-months-show-that-sustainability-is-the-worlds-most-sought-after-asset/

Please log in to upload a file.

There are no updates yet.

Click the Upload button above to add an update.