This content originally appeared on Level Up Coding - Medium and was authored by Dmytro Spilka

It’s been a topsy turvy year for bitcoin. So much so that a bullish buying frenzy that made investors believe just about any price was possible has given way to a substantial collapse heading into a largely uncertain summer.

As the world’s most famous cryptocurrency, bitcoin has been the subject of much speculation about its future value. During 2017’s bull run, when the coin fell just short of $20,000, there was speculation that the crypto market was a bubble ready to burst.

However, following its third halving event on the 18th May 2020, bitcoin began a bull run that would see the coin accelerate to a peak on 14th April 2021 of $64,800 — comprehensively outperforming its former all-time highs.

One month on from Bitcoin’s fresh all-time high came a downturn that at times swept more than 50% of the value of the coin off the market. By late June, BTC’s price had slipped under $30,000 — wiping off much of the progress the cryptocurrency’s price had made over the course of 2021.

(Image: CoinGecko)

As the past year shows, bitcoin recaptured much of the severe volatility the cryptocurrency has been known for as its price started hurtling towards the stratosphere and back.

As the popularity of BTC and the wider crypto ecosystem grew, the impact of negative stories surrounding the cryptocurrency caused deeper market jitters. Elon Musk sparked a massive sell-off when the world’s richest man declared that Tesla would no longer be accepting BTC payments for their cars.

Significant regulatory measures in China have also contributed to a series of sell offs of the cryptocurrency across May and June.

Recently, news of US authorities seizing $2.3 million worth of bitcoin payments to hackers who hacked the Colonial Pipeline in May, and in doing so raised severe concerns about just how secure decentralised cryptocurrencies are.

The use of crypto and the eventual recovery of funds has been interpreted by some onlookers as evidence that BTC isn’t as anonymous and untraceable as we’re led to believe — causing some holders to sell.

Blue Sky Thinking

Prior to the storm, optimism and sentiment surrounding BTC was extremely high — and not only from retail investors.

Over the past year, we’ve seen institutions arrive on the crypto landscape due to more companies understanding bitcoin’s case as a superior store of value. Bitcoin has come to be identified as a quality safe-haven asset ahead of gold — particularly since the beginning of the Covid-19 pandemic. In fact, in the past financial year, bitcoin has outperformed the Nasdaq 10 by 300% and the S&P by almost 1,600%.

Tesla and Elon Musk may have been dominating the headlines due to their $1.5 billion investment in bitcoin in early 2021, but prior to that, MicroStrategy, the largest independent, publicly-traded business intelligence company, had accumulated more than 90,000 BTC in investments — equating to over 3 billion by current valuations.

As businesses identified bitcoin as a potential decentralised hedge against global economic instability in the wake of the pandemic, institutions had begun wising up to this early opportunity to buy into an asset that may retain its value in the face of real-world downturns.

According to some financial experts, the notion of BTC reaching a value of $100,000 in 2021 seemed too conservative. One senior analyst at Citibank, John Fitzpatrick conducted a technical analysis of bitcoin which came to the conclusion that the coin could be worth $318,000 by December 2021.

However, Fitzpatrick’s estimations came back in November 2020, prior to the chaotic beginning to the summer for cryptocurrencies. Could bitcoin really rally to recapture new highs in 2021 following such a significant pullback?

Rallying Towards $100k

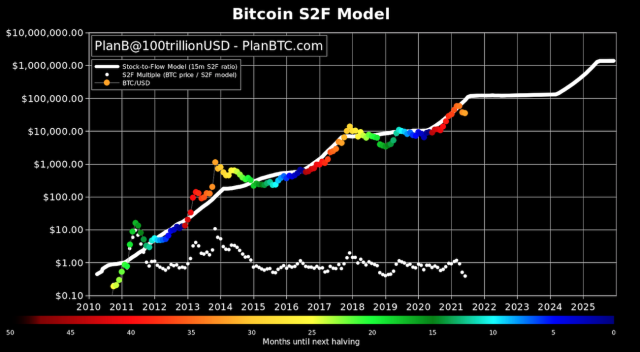

Sentiment surrounding bitcoin is currently bearish, but there’s plenty of potential for optimism ahead, and many investors still follow the coin’s stock-to-flow model as a reason to be cheerful.

(Image: Yahoo! Finance)

As the chart shows, bitcoin’s price has consistently followed its stock to flow model since its creation more than a decade ago. As the coin becomes increasingly scarce after each halving event, it undergoes a rally that boosts its market value.

According to the stock to flow model, bitcoin should still be rallying towards a value of around $100,000 before the end of 2021, before kicking off a bull run towards $1 million following 2024’s halving event.

Bloomberg has also claimed that BTC is more likely to hit $100,000 in 2021 than to continue falling towards $20,000. According to the financial news agency’s Crypto Outlook report from June, “about $40,000 may be the Bitcoin cap for a while within what we see as a resting crypto-asset bull market. №2 Ethereum is rapidly moving toward №1 market-cap status and has been a top driver of the Bloomberg Galaxy Crypto Index in 2021. Bitcoin is more likely to resume appreciating toward $100,000 resistance rather than sustaining below $20,000.”

The more positive outlook from Bloomberg is supported by what appears to be a growing investor base in the wake of the Covid-19 pandemic. Maxim Manturov, head of investment research at Freedom Finance Europe, points to an ever-growing investor base as an indicator for stock market growth.

“What we have analyzed above actually looks like the consequence of the pandemic and the stimulation packages that followed. This created a pool of funds retail investors could start investing into stocks. As per Fidelity report, there were 26M retail accounts in 2020, i.e. up 17% compared to 2019,” Manturov said.

Bitcoin has endured what’s been a testing start to the summer of 2021. Whilst there’s much fear surrounding investments in BTC and other cryptocurrencies, the longer-term outlook appears to be much more positive among commentators.

With an ever-increasing volume of retail investors entering the market and a favourable stock-to-flow model to fulfill, $100,000 may still be in sight for the world’s most famous cryptocurrency.

Road to Recovery: Could Bitcoin Still Top $100,000 in 2021? was originally published in Level Up Coding on Medium, where people are continuing the conversation by highlighting and responding to this story.

This content originally appeared on Level Up Coding - Medium and was authored by Dmytro Spilka

Dmytro Spilka | Sciencx (2021-07-27T14:43:23+00:00) Road to Recovery: Could Bitcoin Still Top $100,000 in 2021?. Retrieved from https://www.scien.cx/2021/07/27/road-to-recovery-could-bitcoin-still-top-100000-in-2021/

Please log in to upload a file.

There are no updates yet.

Click the Upload button above to add an update.