This content originally appeared on Level Up Coding - Medium and was authored by Dmytro Spilka

In a feat that seemed most improbable following harsh corrections in May and June, Bitcoin has soared beyond its former all-time high of $64,800, climbing beyond the $67,000 mark briefly before encountering a patch of resistance. Now the world’s oldest and most famous cryptocurrency has entered a new period of price-discovery, what value can Bitcoin achieve by the end of 2021?

The rise of BTC has also helped to push various altcoins towards new heights, with SOL climbing more than 20% on the 21st October, while Ethereum has also ramped up its rally towards its April all-time high of $4,356.99 off the back of Bitcoin’s price run.

(Image: Visual Capitalist)

However, as the chart above illustrates, the path to a new all-time high hasn’t been entirely smooth sailing. Attributed largely to Chinese regulatory setbacks and concerns about the environmental impact of Bitcoin mining, the value of BTC collapsed by more than 50% in the spring of 2021 after a massive rally at the beginning of the year.

Although Bitcoin’s collapse sparked fears that a bear market would take control of the ecosystem for the foreseeable future, it took just six months for the cryptocurrency to rebound and surpass its April highs.

(Image: CoinGecko)

As the chart above shows, the past year has seen BTC undergo significant price swings, displaying levels of volatility that some commentators claimed we would no longer see due to the sheer volume of institutional investors buying into the cryptocurrency. However, with a significant price run taking place in September, it appears that Bitcoin has generated an impressive level of momentum at the beginning of Q4 2021.

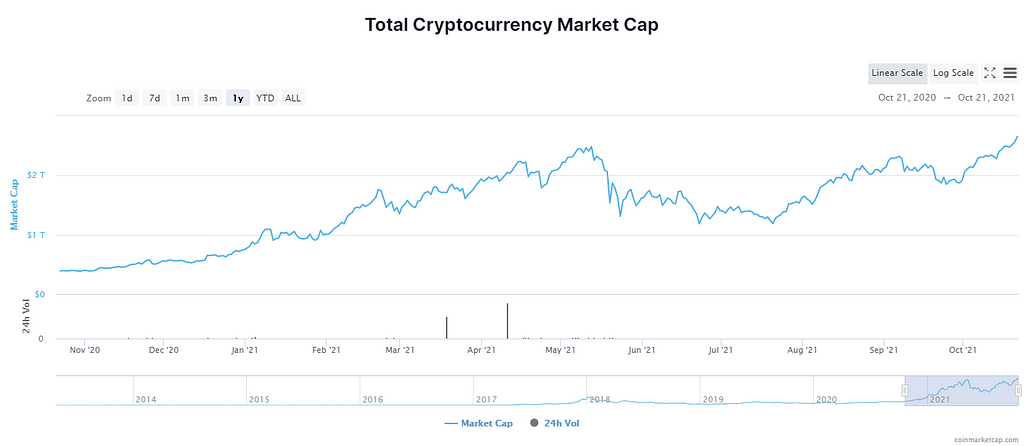

(Image: CoinMarketCap)

We can also see from the data that the total cryptocurrency market capitalization is at an all-time high, weighing in at $2.65 trillion. With such mind-boggling figures in the play, how has BTC managed to achieve such an impressive rally? And how far can the cryptocurrency go by the end of 2021? Let’s take a deeper look into a momentous quarter for the cryptocurrency market.

Why the Bulls Have Come Back

So, what’s caused Bitcoin to resume its bull run following a bearish start to summer? One of the biggest pieces of news revolving around the cryptocurrency market was the debut of the world’s first Bitcoin futures-based ETF, which has made crypto investment far more accessible to traditional stock market investors.

Maxim Manturov, head of investment research at Freedom Finance Europe also notes that we’re seeing far more investor interest in cryptocurrencies due to negative interest rates.

“It is important to note that real interest rates in the US have been negative for an extended period. Real interest rates will likely remain negative even after the likely Fed rate hike in 2022,” Manturov said. “This is important because negative real rates contribute to higher trading and speculative activity in asset markets. To maintain their purchasing power despite the negative rates, the Americans will be looking to generate income from stocks, cryptocurrencies, precious metals and other investments, and trading instruments.”

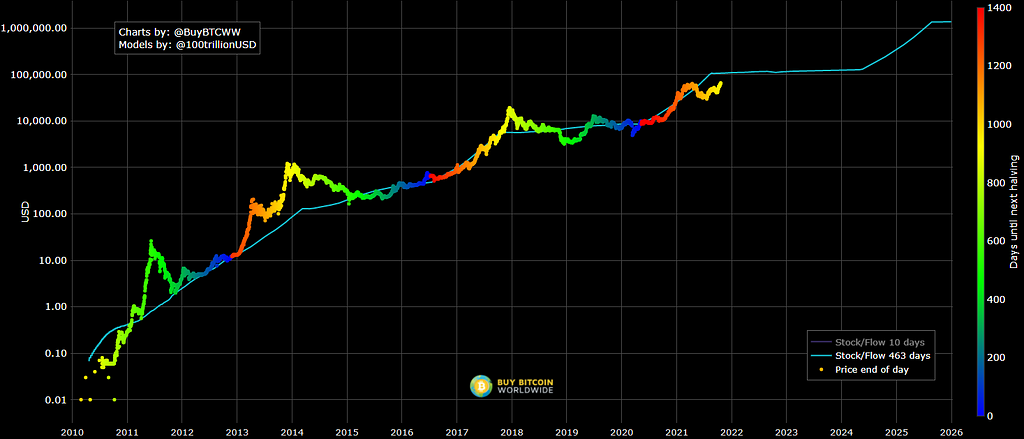

(Image: BuyBitcoinWorldwide)

For other cryptocurrency enthusiasts, the resumption of 2021’s bull run has been anticipated in the cryptocurrency’s stock-to-flow model. Charted above, the stock-to-flow model maps out the growth of Bitcoin following its hard-wired halving events — in which the volume of BTC that miners are rewarded with is halved, impacting the supply over the long term.

At the time of writing, Bitcoin’s stock-to-flow chart estimates that BTC’s value today would be closer to $107,000, rather than $70,000, but given Bitcoin’s sharp trajectory, it may be that the world’s most famous cryptocurrency reaches six-figures sooner rather than later.

What can BTC’s Price Climb to in 2021?

So, where could Bitcoin be heading? CoinDesk’s Damanick Dantes recently claimed that, in the short term, a reasonable price target may be $86,000 — but this may represent a stepping stone towards more impressive sums.

“All eyes are set on the $100K mark, but when retail does rush in and more funds open up to bitcoin, including physically backed ETFs, $100K is unlikely to be the end of it,” said Ben Caselin, head of research and strategy for crypto exchange AAX.

Could BTC reach $100,000 in 2021? The Economy Forecast Agency is cautiously optimistic about the future of the famous cryptocurrency but stopped short of declaring a six-figure end to Q4 — listing a potential high for BTC of over $84,000 by the end-of-year. 2022, the agency believes, may be a different story, with October 2022 predictions positioning Bitcoin at a price of $163,802.

However, not everyone shares the same bullish outlook for BTC. “Usually when an investment hits an all-time high, that is the least ideal time to buy,” says Anjali Jariwala, a certified financial planner and founder of Fit Advisors. “I think it makes sense to wait and see what happens versus buying at an all-time high.”

Bitcoin’s famous volatility stands as a reminder that the world of crypto can be an erratic and wild ride. For this reason, it’s important to exercise caution before getting carried away in a bull run. One thing’s for sure however, Bitcoin’s passage to mainstream adoption shows it won’t be going away any time soon.

Back to the Bull Market: How High can Bitcoin go in 2021 After Smashing All-Time High? was originally published in Level Up Coding on Medium, where people are continuing the conversation by highlighting and responding to this story.

This content originally appeared on Level Up Coding - Medium and was authored by Dmytro Spilka

Dmytro Spilka | Sciencx (2021-10-22T14:10:20+00:00) Back to the Bull Market: How High can Bitcoin go in 2021 After Smashing All-Time High?. Retrieved from https://www.scien.cx/2021/10/22/back-to-the-bull-market-how-high-can-bitcoin-go-in-2021-after-smashing-all-time-high/

Please log in to upload a file.

There are no updates yet.

Click the Upload button above to add an update.