This content originally appeared on Level Up Coding - Medium and was authored by Dmytro Spilka

Modernising the financial sector to encompass the changes that are happening within the technology world, is ensuring that more and more people have access to banking features. The development of cryptocurrencies and investment portfolios within the finance world is something that is very much at the forefront of people’s form of passive income and is growing year on year.

What is blockchain?

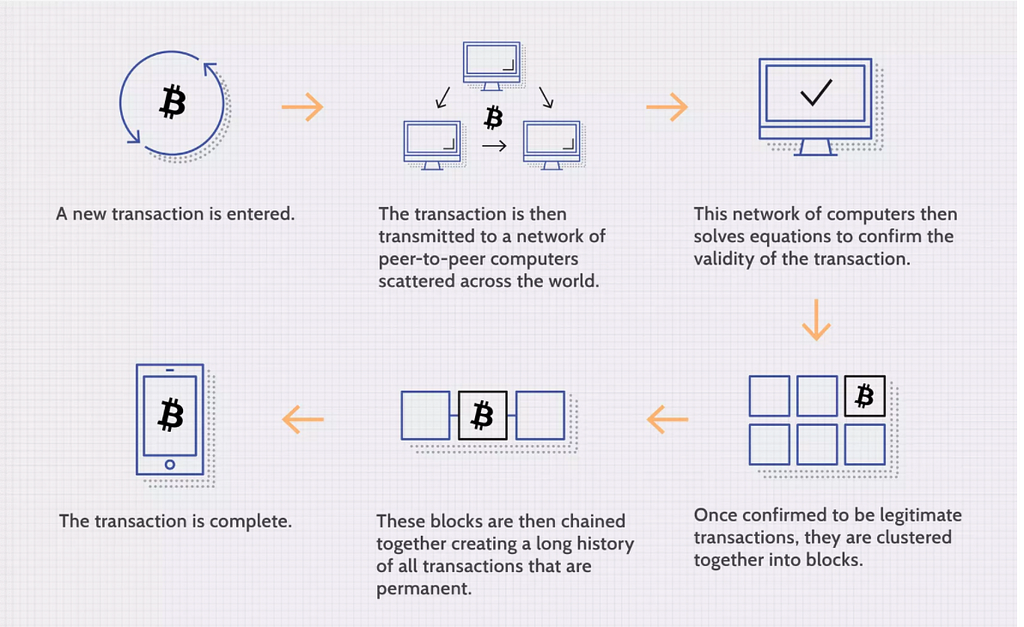

Blockchain is a specific type of database that stores blocks of data together (chained together) in chronological order. It is a complicated method of data storage, however, it is conceptually quite simple. A database is essentially a collection of information that is stored in an electronic fashion. A traditional database and storage method is typically in a table format which results in easier searching and labelling features.

In contrast to a traditional type of database, blockchain is a stricture in blocks that creates a timeline of data as each block of data is given a timestamp (an exact timestamp) when it is added to the chain.

(Image Source: Investopedia)

Blockchain and the banking sector

When it comes to currencies, cryptocurrencies are still the subject of debate as to the future of currency. Blockchain was first applied in alignment with cryptocurrencies. The use of blockchain would ensure that that the qualities of speed and security within cryptocurrencies are protected. The inability of this type of data storage to tamper with makes it the perfect choice when being parallel with cryptocurrency but in recent years the qualities of blockchain also have moved into other parts of the banking sector. The qualities of it ensure that it has been applied in many ways across the banking sectors, including enabling transactions and direct payments.

Using blockchain for direct payments and transactions

Direct payments are those made by cheque and card and in turn, involves risks from both the merchant and the customer. The risks can include fraudulent transactions, potential theft and merchant disputes, but with the implementation of blockchain, these types of direct payment can be essentially risk-free. This is an extremely primary advantage, particularly for high-value purchases. The use of blockchain would not only verify the products being purchased but would also verify the payments in an efficient and smooth sailing manner. Although this application is yet to be made commercially feasible it offers security and advancement to the banking sector.

Transferring Money and Funds

The advantage that comes paired with using blockchain technology has been most prominent when it comes to money transfers. With the globalisation of businesses and banking, the use of money transfers has become relied upon than ever before. The pandemic has also been even more of a catalyst for this. The transfer of fiat currencies means that the utilisation of blockchain for this type of money transfer will simplify the process. The primary benefit is the reduced amount of time and cost that will be felt by banks and financial institutions.

Transaction Details

As outlined, blockchain ensures a timestamp ion when new data joins the chain which ensures that data organised in this fashion is more secure than ever before. Indeed, the efficiency of the transfers themselves is only one of the benefits that the union of blockchain technology and banking have, the details of the transactions will be served by this also. Keeping a safe record of customers, clients and vendors ensure that any details cannot be falsified and wrongly entered. The use of smart contracts is a favourable method of monitoring and recording transaction details, but the use of blockchain technology opens up an even larger array of options to be used when recording the details of transactions.

Increased and Advanced Security

An inarguable benefit to opting for blockchain technology is of course the security that is part and parcel of this type of data storage. This can be applied not only within banking but across any type of business that stores identity records or any contractual details. The greater security that is promised, will go hand in hand with the peace of mind that you get about the data that involves details about your company. When it comes to the banking sector, the details of financial circumstances leaking could incur massive losses and using this type of technology will only be beneficial in the long run.

Data breaches and storage have been in motion for the best part of the last three decades, and the banking sector is one of the largest sectors that implement blockchain technology at this time. The change in the organisational foundation for data storage means that data is protected and highlights that it will have scope for application outside of cryptocurrency. The details of financial institutions and the data of their customers will remain secure and continue to uphold that safety as the world becomes a more digital place.

Financial Inclusivity: How Blockchain Is Enabling Transactions was originally published in Level Up Coding on Medium, where people are continuing the conversation by highlighting and responding to this story.

This content originally appeared on Level Up Coding - Medium and was authored by Dmytro Spilka

Dmytro Spilka | Sciencx (2021-10-28T02:30:04+00:00) Financial Inclusivity: How Blockchain Is Enabling Transactions. Retrieved from https://www.scien.cx/2021/10/28/financial-inclusivity-how-blockchain-is-enabling-transactions/

Please log in to upload a file.

There are no updates yet.

Click the Upload button above to add an update.