This content originally appeared on HackerNoon and was authored by Solvency

:::info Authors:

(1) Pietro Saggese, Complexity Science Hub Vienna (CSH);

(2) Esther Segalla, Oesterreichische Nationalbank (OeNB);

(3) Michael Sigmund, Oesterreichische Nationalbank (OeNB);

(4) Burkhard Raunig, Oesterreichische Nationalbank (OeNB);

(5) Felix Zangerl, Austrian Financial Market Authority (FMA);

(6) Bernhard Haslhofer, Complexity Science Hub Vienna (CSH).

:::

Table of Links

- Background and related literature

- VASPs: A Closer Examination

- Measuring VASPs Cryptoasset Holdings

- Closing The Data Gap

- Conclusions, Declaration of Competing Interest, and References

Appendix A. Supplemental material

3. VASPs: A Closer Examination

Using information from the Austrian Financial Market Authority (FMA), we first describe what financial services they offer and what cryptoassets they support. Next, we complement the FMA data with additional public information collected from the VASPs websites to group them based on similarity scores. Finally, we compare their economic functions highlighting similarities and differences to traditional financial intermediaries.

\ 3.1. The Austrian VASP landscape

\ VASPs in Austria are supervised by the Financial Market Authority (FMA) under the Anti-Money Laundering Act. In December 2022, 24 VASPs were registered in the FMA database[7].

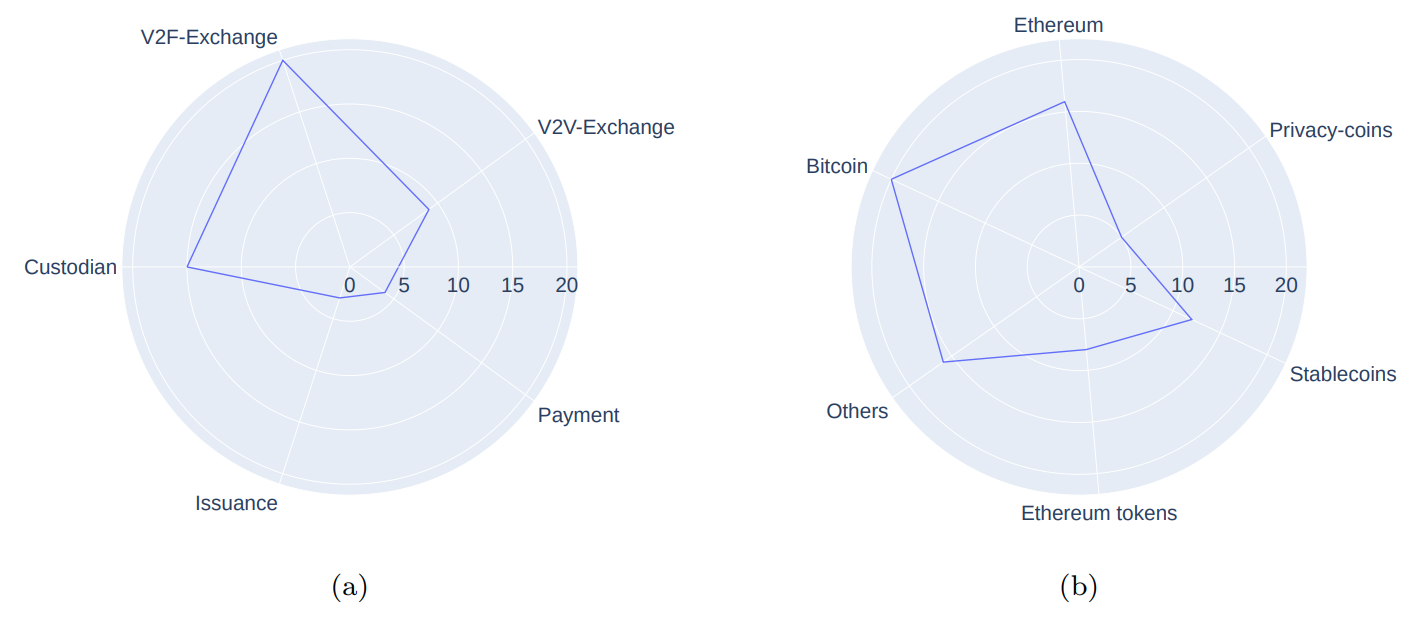

\ Figure 2a shows the aggregate number of VASPs registered for each service described in Table 1. The vast majority of them (N = 20) offers V2F-Exchange, i.e., services to exchange virtual assets and fiat currencies; nine also facilitate the exchange from and to other virtual assets (V2V-Exchange). In most cases, customer funds are or can be kept in custody by the VASP (N = 15). Finally, only a few of them are legally authorized to transfer virtual assets and

\

\ to issue and sell them (respectively services Payment, N = 4, and Issuance, N = 3). Additional details on the number of services offered per VASP are reported in Appendix A.

\ Figure 2b shows what virtual assets are used by the Austrian VASPs. We follow the taxonomy described in Auer et al. (2023) to aggregate cryptoassets into five categories. We could retrieve reliable information for 20 VASPs out of the 24 in the FMA database. Notably, all VASPs offer services related to bitcoins (N = 20). More than 75% support Ethereum (N = 16), and the latter typically also support Ethereum tokens, i.e., ERC-20 and (or) ERC-721 compatible non-native tokens, and stablecoins (respectively N = 8 and N = 12). A limited number of VASPs also provide services related to privacy-focused cryptoassets (i.e., Monero, Dash, Zcash). Finally, several VASPs also support tokens native to other DLTs (e.g., Litecoin or Cardano).

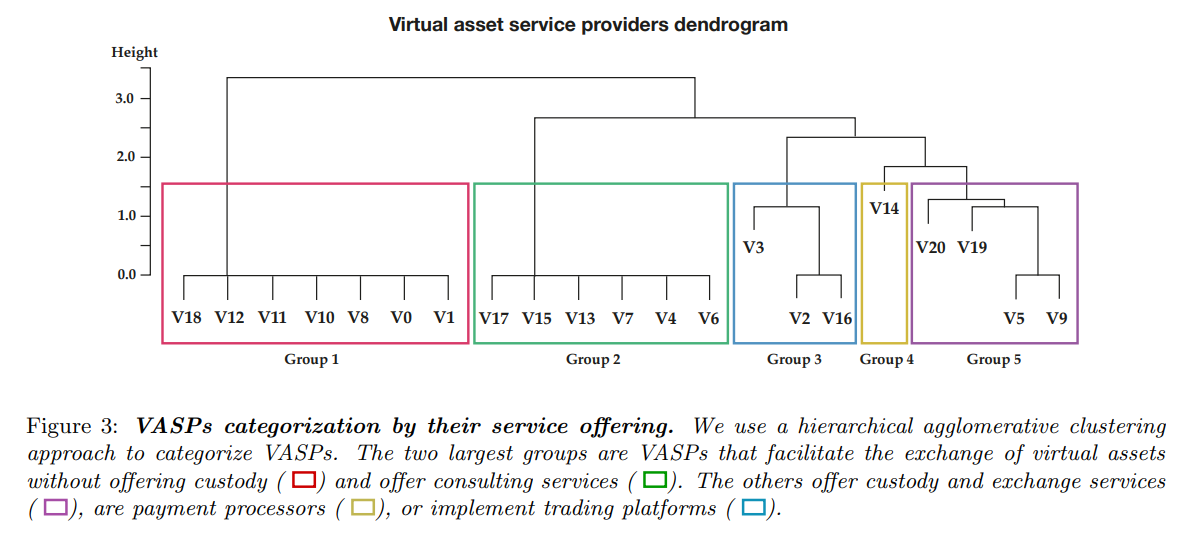

\ In addition to FMA data, we collect additional public information documented on their websites. Our aim is to categorize VASPs by their service offering. We construct categorical variables that indicate whether the VASP offers custody services, facilitates payments, allows users to exchange cryptoassets, implements a trading platform, or offers consulting or investment services. We consider 21 VASPs for which we could gather sufficient information. Data for each (anonymized) VASP are reported in Appendix A. Whilst the sample is small and the features are few, to ensure consistency and objectivity in categorizing VASPs we exploit an unsupervised learning method. We aggregate them using the hierarchical agglomerative clustering (HAC) method (Murtagh & Contreras, 2012). With this bottom-up approach, objects are iteratively clustered based on their similarity. The two main parameters of HAC are the distance among objects, and the linkage method, i.e., the distance used to merge groups. In our setting, we select the Euclidean distance and the Ward metric, and distances are iteratively computed using the Lance–Williams update formula. Results are similar when using other parameters. We report our classification in Figure 3. It categorizes VASPs into five clusters: the first one (red rectangle, N = 7) includes VASPs that do not keep customers’ funds in custody, and only facilitate the exchange of virtual assets for fiat currencies and (or) other virtual assets. Some of them automate the process through physical vending machines. Thus the first left branch mainly separates VASPs that offer custody and those that do not. We identify them as “Group 1”.

\ The green rectangle identifies VASPs providing investment advice and/or portfolio management in addition to custody services (N = 6). They propose investing strategies, give advice on portfolio management and coin selection services, and in some cases, lend customer funds. These VASPs are referred to as “Group 2”.

\ The purple rectangle (“Group 5”) aggregates VASPs that act as cryptoasset custodians.

\

\ Typically, they also facilitate the exchange of cryptoassets and are similar to VASPs in the blue rectangle (“Group 3”). These VASPs in addition provide customers with an internal trading platform, manage and match orders in a private limit order book, and update their account balances in cryptoasset or fiat money when trades are executed. Trades executed in private ledgers do not affect the public distributed ledgers unless the customers withdraw cryptoassets from the service. Such VASPs play an essential role in the crypto-financial system. As a result of the matching mechanism for demand and supply, these are the platforms where price formation takes place. The other VASPs derive their offered prices from other platforms as an exogenous variable. In the following, we consider these two as a single group (i.e., Group 3).

\ All the VASPs in the groups described above are cryptoasset centralized exchanges, or CEXs. The remaining VASP in the yellow rectangle is instead a payment processor service. It offers solutions to facilitate the purchase and sale of commodity goods with cryptoassets; such VASPs play a minor role in the crypto ecosystem.

\ 3.2. A comparison with traditional financial intermediaries

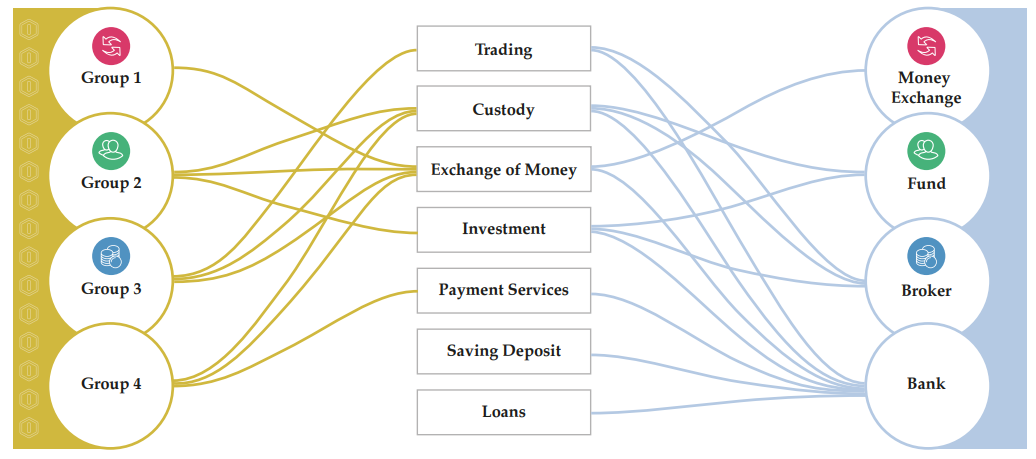

\ Having outlined the landscape of VASPs in Austria, we are now interested in understanding how they differ from traditional financial intermediaries. Figure 4 stylizes the traditional financial intermediaries on the right and the VASPs on the left. In the middle, rectangles represent the primary economic services, and links indicate what services each intermediary category offers. The comparison shows that an analogy with traditional intermediaries exists for three out of the four groups described in Figure 3. More specifically, VASPs in group 1 operate similarly to money exchanges. Indeed, the only service they offer is to buy and sell virtual assets for customers. VASPs in group 2 provide investment services to their users, akin to funds. Third, groups 3 (and 5) include VASPs allowing users to trade, keep their funds in custody, and thus act as brokers, connecting buyers and sellers to facilitate a transaction. The last group that provides payment services can be compared to payment processor systems.

\ Interestingly, we find that the comparison of VASPs to banks can be misleading: while the two share overall several financial services, such as exchanging money, trading, or investing, banks also enable customers to open loan positions with the funds they hold and to open savings and deposit positions. On this note, we mention that some VASPs have recently acquired an e-money institution license. However, that does not qualify them to offer bank-type financial services automatically. First, e-money institutions do not have the same supervisory requirements as traditional banks. Second, they do not necessarily offer bank-type financial services — they can e.g. use the license only to process their fiat payments. Further information on the

\

\ taking up, pursuit, and prudential supervision of the business of electronic money institutions can be found in the Directive 2009/110 of the European Commission (EC, 2009).

\

:::info This paper is available on arxiv under CC BY 4.0 DEED license.

:::

[7] https://bit.ly/3kMUkwg

This content originally appeared on HackerNoon and was authored by Solvency

Solvency | Sciencx (2024-06-19T16:00:33+00:00) Assessing VASP Solvency For Cryptoassets: A Closer Examination. Retrieved from https://www.scien.cx/2024/06/19/assessing-vasp-solvency-for-cryptoassets-a-closer-examination/

Please log in to upload a file.

There are no updates yet.

Click the Upload button above to add an update.