This content originally appeared on HackerNoon and was authored by Daniel O'Keeffe

\ These days, it can be hard to keep track of all the wanton hypocrisy and falsity about Bitcoin. The mainstream media (MSM) is continually retracing its steps and making up new narratives, never held accountable for its previous lies.

\ This page is intended to form a succinct repository of clear and blatant lies/misdirection in relation to Bitcoin, and crypto in general. Keeping score of all the lies is a full-time job, and would take a huge budget and an entire panel.

\ Like they have at the Wall Street Journal (WSJ), which published 3,000 negative-sentiment BTC articles over a 9 year period. Total articles analyzed? 3,000.

\ Given that the MSM seems dedicated almost exclusively to the publishing of fake news, we can only give a brief account in relation to the obvious non-truths.

\

The (Greatly Abbreviated) List of Lies

Jamie Dimon of J.P. Morgan publicly criticized Bitcoin on multiple occasions in numerous media outlets - while his bank developed its own blockchain system (Onyx) on similar principles. As recently as 2024, his position has not changed. According to Dimon, Bitcoin is only invested in by murderers and drug dealers.

\

HNW investors Warren Buffett and Charlie Munger have made numerous detrimental references to Bitcoin, called it a ‘Ponzi Scheme’ or ‘Rat Poison Squared’ and similar terms. The insults directed toward the financial liberation technology remained the same regardless of price increases, ETF adoption, and positive on-chain improvements.

\

Christine Lagarde, ECB President, has stated that Bitcoin is speculative, utility-free, dangerous, and needs to be regulated. This is pretty much the typical narrative/position pushed forward by all prominent fiat banking representatives.

\

The frequently cited ‘Bitcoin uses up more electricity than a small country’ narrative was reported on by practically all major MSM outlets. The premise of this is actually accurate, but misleading and establishment-promoting. It paints a narrow picture in terms of global energy usage.

\

The SEC has been known to overstep its bounds and has published confusing information about the space, making investment and business nearly impossible. Thankfully, several Supreme Court lawsuits are curtailing the SEC’s overreach of its powers, under the highly unpopular Gary Gensler.

\

Due to lax security measures on the SEC’s official Twitter account, a hacker created numerous fake tweets regarding Bitcoin ETF approval, in early 2024. It caused over $90 million in liquidations. Market participants questioned how an authority responsible for safeguarding billion-dollar markets failed to secure its own Web2 social media account.

\

99Bitcoins keeps an online obituary of how many times Bitcoin is ‘set to ‘die’, as reported by newspapers and social media posts from prominent individuals. So far, Bitcoin has ‘died’ 477 times, but the obituary has not been updated in a while.

\

As recently as March 2024, The Atlantic claimed that Bitcoin has “yet to find a use case”, before insinuating that crime was its main use case. This hack piece went as far as to claim that art and gold only have value due to societal delusion. “People trying to explain crypto’s staying power often compare it to other assets that, like gold, diamonds, or fine art, have little intrinsic value apart from collective societal delusion.”

\

Another hilarious blooper from the Atlantic, this time from March 2023 (not a good month for this particular outlet , t would seem). In a blog post titled ‘Crypto Is Nearly Over’, the first line reads “At this point, for most of us, cryptocurrency seems like nothing more than a fad”.

\

Multiple outlets (Bloomberg, PBS, CNBC, NY Times) continually report on crypto being used for terrorist financing, particularly Hamas. This is despite the fact that the US Treasury has stated that terrorists prefer fiat money. If the MSM can find a way to link Bitcoin with a negative event, they will take the opportunity.

\

Danske Bank was caught for $2 billion in money laundering. HSBC for $1.2 billion in 2012. Wells Fargo was fined $3 billion twice. Citicorp, Barclays, JPM, RBS,UBS, and other large banks were collectively fined $9 billion for LIBOR price fixing. For destabilizing the planetary economy through the subprime mortgage crisis, BoA was fined $30 billion while JPM was charged $13 billion. Yet Bitcoin is used ‘by criminals’.

\

Fake Narrative #1 - Bitcoin Is Only Used By Criminals

A common redirection tactic is to pretend that Bitcoin is used solely ‘by criminals’ for money laundering.

\ The irony of this could not be more profound in a 100% fraudulent system where banks and politicians purposefully crash the economy, print money in response, and effectively hand it to themselves by purchasing Treasury Bonds (which are now at record highs, which has resulted in 40-year high inflation figures).

\ Printed money is never handed to real people.Trillion-dollar fraud becomes the norm while failing to report earnings (from actual work done), is an act worthy of imprisonment. Despite the fact that money printing is itself a fraudulent procedure, the banking system itself has a strong history of criminal activity and AML non-compliance, and so have many corporations.

\

“As the value goes up, heads start to swivel and skeptics begin to soften. Starting a new currency is easy, anyone can do it. The trick is getting people to accept it because it is their use that gives the money value.“ - Adam B. Levine, CEO of Tokenly

\ In 2022, banking had over $2 billion in AML fines. Crypto had $30 million. This would seem like a win for crypto, but, as usual, they changed the rules to change the narrative. In 2023, crypto fines were $5.8 billion; banking was $585 million. Either crypto firms collectively decided to become 200x more fraudulent within a year, or the sector was deliberately targeted.

\ Binance’s $4.3 billion fine made up a significant part of this increased number. But even so these figures are small. To put things into the right perspective, JPM was fined a whopping $920 billion for market manipulation of US Treasuries - the very market that all that printed money is used to prop up!

\

Fake Narrative #2 - Bitcoin Has No Real Utility Value

To this day, people are still saying that Bitcoin has no real value and is backed by belief. Yet this is an identical situation to fiat money. Since 1971, the US dollar has not been pegged to gold or any other real-world asset. It has no utility value whatsoever aside from enforcement by US legal authorities.

\ You could also argue that Bitcoin is indirectly pegged to a very real and pure commodity pair - computing hardware costs and energy prices. It does cost a lot to mine Bitcoin using ASICs - that’s one of the criticisms that actually holds true. At the same time, this is needed to secure the network and ensure its decentralization.

\ It’s technically true that Bitcoin has no ‘utility value’. But you can’t make that point when endorsing a fiat currency which also has zero utility value. Plus, Bitcoin mining still operates within free market principles - if electricity prices are too high, for instance, it may not be feasible to open a mining farm. In contrast, central banks can print money as they wish, at no consequence to them, but with major consequences for civilians.

\

“Trading Bitcoin is like trading Apple, Amazon, Google, or Facebook a decade ago. The more you obsess over timing the market, the more mistakes you make. They were all technology networks that were dominant & destined to grow.” - Michael Saylor, Former CEO of MicroStrategy

\ It’s very interesting that many prominent investors still think that Bitcoin having no utility value is a legitimate criticism, while failing to recognize that fiat also has no utility value. Neither does any currency. Peter Schiff still criticises Bitcoin, just like he did in 2013, despite a ~4,000x price increase. Can this be anything other than delusion, when people hold on to their positions despite what actually happens in the real world?

\

Fake Narrative #3 - Bitcoin Is A Ponzi Scheme/Pyramid Scheme

This is another misconception very popular among establishment outlets like the Financial Times. A Ponzi Scheme is one where earlier investors are paid by more recent investors. When new investors fail to show up, the scheme collapses because there is nothing to support earlier investors. So this term has no relationship to Bitcoin whatsoever.

\ Bitcoin is a self-sustaining ecosystem built purely from free market economics. There is no company and no executives, and therefore nobody is running the so-called Ponzi Scheme. There is no marketing department. The original Ponzi scheme had an individual that set it up to make profits for himself, and had to continually entice more investors to keep the scheme going.

\

“Bitcoin is a tool for freeing humanity from oligarchs and tyrants, dressed up as a get-rich-quick scheme.” – Naval Ravikant, former CEO of AngelList

\ There is no individual (Charles Ponzi). There is no scheme (marketing department). Bitcoin is in no way a Ponzi Scheme, has no resemblance to it in any way, and is has a set tokenomics architecture with 4 year halving that make it set to last for many decades. Moreover, we are going to see Bitcoin Circular Economies that ensure that Bitcoin will generate more value to wider society, instead of leaching value from society, a core feature seen with centralized banking.

\ The same applies to Pyramid Scheme, which is similar to the Ponzi Scheme. Because there are no recruiters and no hierarchy. In fact, the geometry of the Pyramid more closely that of the fiat system, where 1% are taking 99% of the profits as energy is harvested upwards. Both schemes work by promising ridiculous returns to gullible investors. Bitcoin does not offer any returns, because it is not a yield bearing asset. It has no feature that resembles a Pyramid/Ponzi Scheme.

\

Fake Narrative #4 - Bitcoin Needs To Be Regulated

This is a misleading narrative because the entire purpose of Bitcoin is that it’s not regulated. The entire point is to avoid KYC procedures and bypass regulation, which are a means of illegal data harvesting by banks, governments, and FIs.

\ The asset is thriving purely because it’s regulation free. It’s well known among business owners that government regulation slows down economies and stifles innovation. The internet, arguably the most successful free market innovation of all time, worked so well because the government had nothing to do with its growth. It grew organically and without regulation or market intervention, flourishing on open market principles.

\ Ideological positions aside, the fact is that it is impossible to regulate Bitcoin and other cryptos. The legal system is known for its slow rate of growth and the fact that economy-destroying legislation is never repealed. Given the rate of growth of the cryptocurrency industry, in conjunction with AI, the government has 0% chance of effective regulation in the space.

\

"You can't stop things like Bitcoin. It will be everywhere, and the world will have to readjust. World governments will have to readjust." —John McAfee, Founder of McAfee Associates

\ Plus, the SEC has a disastrous track record. It took longer than 8 years to finally decide that XRP was not a security offering, except when sold to institutions. That’s a single case, on a single issue, at an enormous cost.

\

Fake Narrative #5 - Bitcoin Uses More Energy Than Most Small Countries

Finally, we arrive at something that holds some truth. We have something of a boy who cried wolf scenario here because the MSM have such a history of deceit, that it’s easy to overlook occasionally accurate reporting. This is a relatively nonpartisan article from the NY times, that outlines some genuine reasons as to why BTC mining needs is so expensive.

\ Bitcoin is incredibly resource-intensive due to its Proof-Of-Work model. So it is a tradeoff between network security. This is a legitimate concern and is something that Bitcoin maximalists (like myself) have to admit to and deal with.

\ However, the indirect effects of the fiat model have to be pointed out. The fiat architecture is used to support wars and surveillance operations that the public would never vote on if given the choice. And there is no control study in terms of what the fiat server model uses, which is much more.

\ To get a broader understanding of the effects of Bitcoin’s energy consumption, please read this amazing article from Corner Research. Bitcoin uses a lot of energy, but there is a much wider framework in play. The article highlights the effects of Bitcoin’s Lightning Network against things like Electric Vehicles and the fiat banking sector.

\

\ In sum, the study relied upon by the MSM surrounding BTC energy consumption did not factor in Layers 2s, did not compare it to the existing banking system, and did provide an adequate frame of reference for energy usage relative to other daily activities.

\

"Whereas most technologies tend to automate workers on the periphery doing menial tasks, blockchains automate away the center. Instead of putting the taxi driver out of a job, blockchain puts Uber out of a job and lets the taxi drivers work with the customer directly." - Vitalik Buterin, Co-Founder of Ethereum

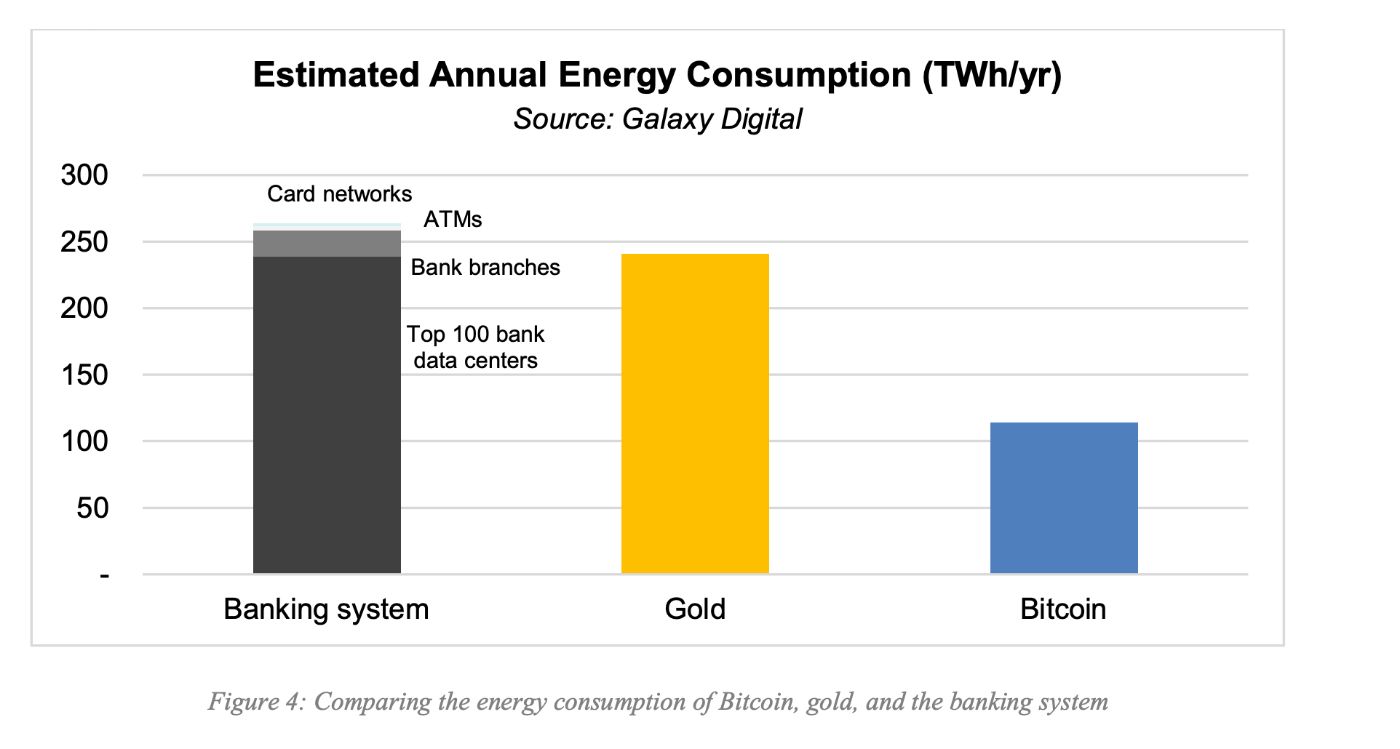

\ The media reporting was highly misleading. In a 2021 Galaxy Digital research report, it was revealed that the energy consumption of the data centers of the leading 100 global banks exceeds more than double that of the Bitcoin network.

\

Other Questionable MSM Narratives

Bitcoin will be replaced by better altcoins → FALSE. It has first mover advantage and benefits from a powerful network effect. First time investors will always have some BTC. It has a huge trade volume and active users. Layer 2s like Rootstock are being built to improve functionality, scalability, and cost.

\

It's slow and expensive → FALSE. It was slow and expensive at one point. Ethereum suffered from much higher gas fees. And Solana is always congested. Both of these are supposed to be much faster and cheaper.

\

It’s hard for newcomers → TRUE. Like all new endeavors, it can take some time to get to known the ecosystem. It can be a little unforgiving - “Not your keys, not your coins”. But you know what’s also very hard for newcomers? Everything. It takes time and patience to learn something of value.

\

Bitcoin is volatile → TRUE. This is to be expected with a technology that is being used to replace a deprecated and highly corrupt fiat architecture. Problematic, but overemphasized.

The Worst Offenders

What mainstream outlets rank the worst in terms of Bitcoin propaganda? Pretty much all of the most traditional outlets have a shocking track record in terms of objective reporting. But the Wall Street Journal (WSJ) easily takes first prize.

\ A study covering 3,000 Bitcoin-related articles published on the WSJ found that all of them had a negative sentiment score, from the period of 2013 - 2021. Top marks for consistency, if not objectivity. The study used ‘topic modeling analysis’ to generate a sentiment score for each article, using predefined positive and negative word lists. The study also revealed a hype score, showing a correlation between media coverage and Bitcoin’s financial performance.

\ Unfortunately, few sentiment analysis studies have been completed on other offending outlets such as the Financial Times, The Atlantic, The Conversation, BBC, CNN, etc. The focus for studies mainly is on how media coverage affects the price, not on which outlets have distinct anti-crypto narratives based on clearly defined negative/positive keyword lists.

\

:::tip As a previous journalist and crypto news editor, I feel it’s worth mentioning that all media is biased, without exception. It’s the hidden biases that get you, where outlets pretend to be objective using certain portions of data. Data analysts/programmers will also understand this - you can splice data in any direction to get it to say what you want.

:::

\ The Atlantic, the Financial Times, and the Wall Street Journal have been particularly illogical yet consistent in their criticism of Bitcoin. With the WSJ, 3,000 out of 3,000 is a perfect score exemplifying its clearly biased position. Other outlets like The Conversation are consistently negative, but are much more subtle in their approach.

Wrapping It Up

The fact of the matter is that the MSM is little more than an establishment tool used to separate/poliarize the population and to destroy Bitcoin, or bring it within the existing fiat architecture which is run by a small number of bankers and politicians.

\

"Unpopular but true: Bitcoin is the most significant monetary advance since the creation of coinage." - Edward Snowden, Whistleblower

\ Bitcoin and other cryptos are there to create new, non-interventionist economies and legal systems free from banking manipulation and government interference, with democratic autonomous voting mechanisms.

\ That’s a reality that few people are brave enough to declare outright, still imagining that the banking/political system and Bitcoin can ‘get along’, despite being completely opposite technologies. One is based on dominance, control, aggression, and privacy intrusions; the other on individual autonomy, the right to privacy, and civil liberties.

\ As clearly evidenced by the Bitcoin Genesis block, the technology was created to replace the reptilian banking architecture - not to be integrated by it.

\ If you hear anything else, you’re listening to fake news.

This content originally appeared on HackerNoon and was authored by Daniel O'Keeffe

Daniel O'Keeffe | Sciencx (2024-06-25T15:00:27+00:00) The Bitcoin Hypocrisy Repository – Keeping Track Of Mainstream Lies & Fake Narratives. Retrieved from https://www.scien.cx/2024/06/25/the-bitcoin-hypocrisy-repository-keeping-track-of-mainstream-lies-fake-narratives/

Please log in to upload a file.

There are no updates yet.

Click the Upload button above to add an update.