This content originally appeared on HackerNoon and was authored by SEC vs. the World

:::tip SEC v. Consensys Software Inc. Court Filing, retrieved on June 28, 2024, is part of HackerNoon’s Legal PDF Series. You can jump to any part in this filing here. This part is 14 of 26.

:::

B. MANA

162. “MANA” is the digital token minted by Decentraland. Decentraland is a virtual reality platform that began development in June 2015 but was not made available to the public until its launch in February 2020. Decentraland was launched through an entity named Metaverse Holdings by a team of core individual developers: Ariel Meilich, Esteban Ordano, Manual Araoz, and Yemel Jardi. Decentraland operates on the Ethereum blockchain. According to Decentraland’s website, www.decentraland.org, Decentraland is a three-dimensional virtual reality platform, where users can create, experience, and monetize their content and applications.

\ 163. According to Decentraland’s website, MANA serves as the crypto asset involved in all transactions in the Decentraland virtual reality ecosystem. On August 18, 2017, Decentraland held an initial coin offering in which MANA tokens were exchanged for ETH tokens, raising approximately $24.1 million. Currently, there is a total supply of approximately 2.19 billion MANA tokens.

\ 164. Decentraland offered early contributors to the Decentraland ecosystem a discounted price when purchasing MANA.

\ 165. From the time of its offering, MANA was offered and sold as an investment contract and therefore a security.

\ 166. The price of all MANA tokens goes up or down together.

\ 167. MANA has been available for buying and selling through MetaMask Swaps since at least October 2020.

\ 168. The information Decentraland publicly disseminated would lead a reasonable investor, including those who have purchased MANA since October 2020, to view MANA as an investment. Specifically, MANA holders would reasonably expect to profit from Decentraland’s efforts to grow the Decentraland protocol because this growth would in turn increase the demand for and value of MANA.

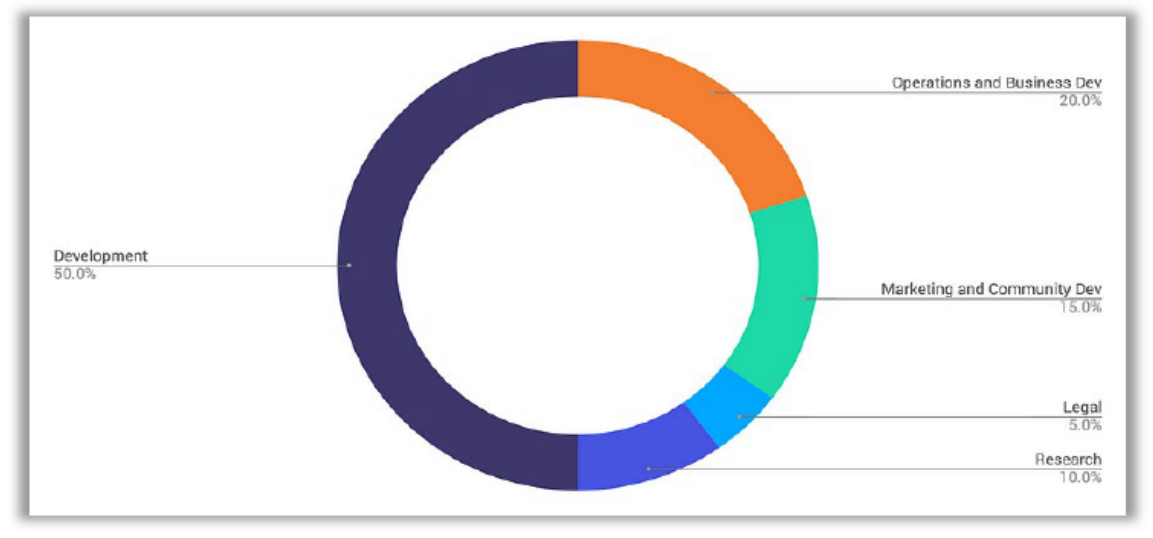

\ 169. Investor proceeds raised during the MANA ICO were pooled to fund the marketing, business expenses, and completion of the Decentraland platform. For instance, on July 5, 2017—a few weeks before the MANA ICO—Jardi published a blog post detailing Decentraland’s intended use of revenue from the token sale as follows:

\

\

- The blog post further explained that the “top priority“for use of the revenue was to develop a virtual world and that even after Decentraland was created, “the development budget will focus on the continued improvement of the end-user experience within the world browser“.

\

- Indeed, Meilich explained in a separate blog post that after the ICO, Decentraland would implement a “Continuous Token Model,“ where it would increase the MANA supply by 8 percent in the first year, followed by a lower rate in subsequent years, to allow Decentraland to “regularly expand while accommodating new users … The proceeds of the tokens sold by [the Continuous token Model] will finance Decentraland over the long haul, perpetually aligning it with the prosperity of the network.“

\

- In April 2020, the Decentraland Team announced the creation of the Decentraland Foundation (the “Foundation“), which today holds the intellectual property rights over and makes available the products and services, including virtual environment and tools, offered on the Decentraland platform. Meilich publicly stated that the distribution of the initial supply of MANA tokens issued at the time of the ICO would be as follows: 20 percent to the founding team, advisors, and early contributors: 20 percent to the Foundation; 40 percent to be available for purchase by the public; and 20 percent reserved to “incentivize early users, developers, and partners who want to build within Decentraland.”

\ 173. As Meilich explained in his public blog post, “To incentivize value creation within Decentraland, extra tokens will be allocated to the [development team], organization, and a reserve to accelerate Community and Partner engagement.”

\ 174. For example, Decentraland publicly issued a whitepaper (“Decentraland Whitepaper”) describing the architecture that would be built in the virtual reality platform and steps that would be taken to support Decentraland’s growth. It further made clear that the development of the platform was only beginning, and listed a number of “Challenges” that would need to be addressed in the development process in order for the platform to succeed.

\ 175. Decentraland has continued to invest efforts in new developments and tools for the platform. According to Melich, even after the ICO, Decentraland was still “preparing a land allocation policy to ensure fair distribution, as well as a method for groups to purchase larger contiguous plots of land.” Since the ICO, Decentraland has developed tools for purported use on its platform (e.g., the “Marketplace” and “Builder” tools). In a public blog post published on March 19, 2018, the Decentraland team described the marketplace tool as the “first … in what will be a series of tools.”

\ 176. Additionally, the Decentraland Whitepaper explained how the Foundation would “Foster[] the Network” in that it will “hold contests to create art, games, applications, and experiences, with prizes contingent on meeting a set of milestones. At the same time, new users will be assigned allowances, allowing them to participate in the economy immediately.” The Decentraland Whitepaper further claimed, “These financial incentives will help bootstrap the utility value of the network until it independently attracts users and developers.”

\ 177. The Decentraland Whitepaper and website have also marketed that the protocol “burns” (or destroys) MANA tokens when used within the Decentraland ecosystem.

\ 178. The Decentraland Whitepaper is still available on the Decentraland website.

\

:::tip Continue Reading Here.

:::

:::info About HackerNoon Legal PDF Series: We bring you the most important technical and insightful public domain court case filings.

\ This court case retrieved on June 28, 2024, storage.courtlistener.com is part of the public domain. The court-created documents are works of the federal government, and under copyright law, are automatically placed in the public domain and may be shared without legal restriction.

:::

\

This content originally appeared on HackerNoon and was authored by SEC vs. the World

SEC vs. the World | Sciencx (2024-07-09T22:45:14+00:00) Decentraland’s MANA Token Under SEC Scrutiny: Implications for Virtual Reality Investments. Retrieved from https://www.scien.cx/2024/07/09/decentralands-mana-token-under-sec-scrutiny-implications-for-virtual-reality-investments/

Please log in to upload a file.

There are no updates yet.

Click the Upload button above to add an update.