This content originally appeared on HackerNoon and was authored by Kiba Gateaux

The recent stock market “crash” in Japan validates my hypotheses that I’ve had the past 18 months on why Japan is a HUGE opportunity. I'm ending my 7-year nomadic streak to move there permanently.

Disclaimer: While I've been thinking about this for over a year, I just threw this whole essay together today, research and all. I would love feedback, comments, and questions for my follow-up posts.

\ Originally posted on my dev blog Nüō Type Nation

My Personal History With Japan

I've been going to Japan for 10 years. The yen, after the last volatile 6 months, is still ~50% cheaper than it was when I first went in 2015. My decisions aren't based on the short-term news hype cycle that popped up recently (akiyas on Instagram, stock crash last week ). I’ve spent nearly 3% of my entire life living in Japan and plan on spending the majority of my next 10 years there.

\ April 2015 - June 2015: Broke ass 19 year old. Spent 3 months WWOOFing in Shimane and Hokkaido. Hitch hiked across half of Japan from Hiroshima to Fukushima sleeping on the highway/streets and surviving on 7-Eleven.

\ March 2019 - November 2019: Lived in Osaka because they were the nicest, funniest people I met on my first trip and they had the best food. Osaka >>> Tokyo. Decided Japan wasn’t for me because my environment felt very static/no growth which was no bueno for an ambitious 22-year-old.

\ March 2023: Was in a bad mental state so went to Japan for vacation. Healed me beyond belief. Remembered why I wanted to live there in the first place and decided to live there again.

\ April 2024: Scouting trip for property across the country. Visited Tokyo, Izu, Fukuoka, Goto, and Osaka. Stayed at Akiya Collective and really got to know the founder. Decided to buy property near them.

\ September 2024: Scouting and starting the process of closing on two properties in Nagano and Hokkaido with two different art collectives I'm interested in working with. Meeting with a VC fund and Shibuya reps to negotiate a visa.

\ December 2024: Hopefully starting my permanent move there if I can close on properties and visas. Otherwise, hopefully finishing those processes.

TLDR My Japanese Supremacy Theses

Japan will enact more innovative policies than other countries, especially developed Western ones.

\

Explosive adoption of accelerationist technologies like nuclear, AI, robotics, crypto, and longevity.

\

Japan's strong culture + isolationist nature will make them a bastion of creativity and innovation while the rest of the world continues to homogenize as "The West."

\

\

1. Innovative Policies & Policy Innovation

In the past 200 years, Japan has already gone through two major economic restructurings - the Meiji period from feudal to industrialized and post-WWII from industrialized to modern. Both times the transitions were fast and put them at the forefront of global technology where just a few years before they had been dominated by The West.

\ These were driven by strong government, clear visions, and cutthroat implementation to achieve their goals. I'm taking the bet that they are on the brink of another quantum leap and their economy will have a massive turnaround in the next 10 years.

\ Starting with the most relevant point that inspired this post - interest rate hikes.

\ The BoJ rate change tanking the entire market shows how influential Japan is to the world economy even just from a financial sense. If Japanese monetary policy can add $1.4 TRILLION to the US stock market, then they can add $1.4 TRILLION to the JP stock market.

\ It’s obviously easier said than done and not a direct correlation, e.g., no startup ecosystem with IPOs over past decades, but instead of funding foreign hedge funds with cheap rates, they can change monetary/financial/tax/tech policy in favor of funding domestic startups. And now, they have data to prove how valuable these policies can be to their economy

\ “But the stock market crash.” Ok so? The US stock market crashed in 2020, 2008, 1987, etc. With a long enough time horizon and a reasonably decent plan, a market crash doesn’t matter.

\ They were willing to challenge the status quo in monetary policy by persisting with negative interest rates for nearly a decade, even after COVID when even the ECB buckled, and raising rates for the first time in nearly 2 decades; a stark contrast to ECB and the US who have had positive rates for most of that time period.

\ Long-running unconventional strategy AND a rapid, decisive shift to "normal" monetary policy show the government is capable and willing to take extreme steps to fundamentally change the construct of the Japanese economy. While major changes, interest rates are a small and relatively simple change; what will they do next to overhaul their economy?

\ I believe this is only the start. Notably, they increased rates because they saw positive development in the economy. To be fair, this could also be an insignificant detail as it was largely out of control since 1. they were no longer competitive on the global market and 2. they were incapable of fully controlling the yield curve in the first place.

\ Increasing rates signal confidence in the economy and may attract foreign investment (not me, I was already investing). Some might argue that higher rates might slow growth further but "normalizing" monetary policy may bring long-term financial stability and could encourage more efficient capital allocation to the Japanese market.

\ Yen price increasing, decreases exports which is sending stock prices down because they are an export economy - for now. Not a huge problem if you believe they're moving to an even more isolationist and not dependent on imports for energy (still need manufacturing inputs).

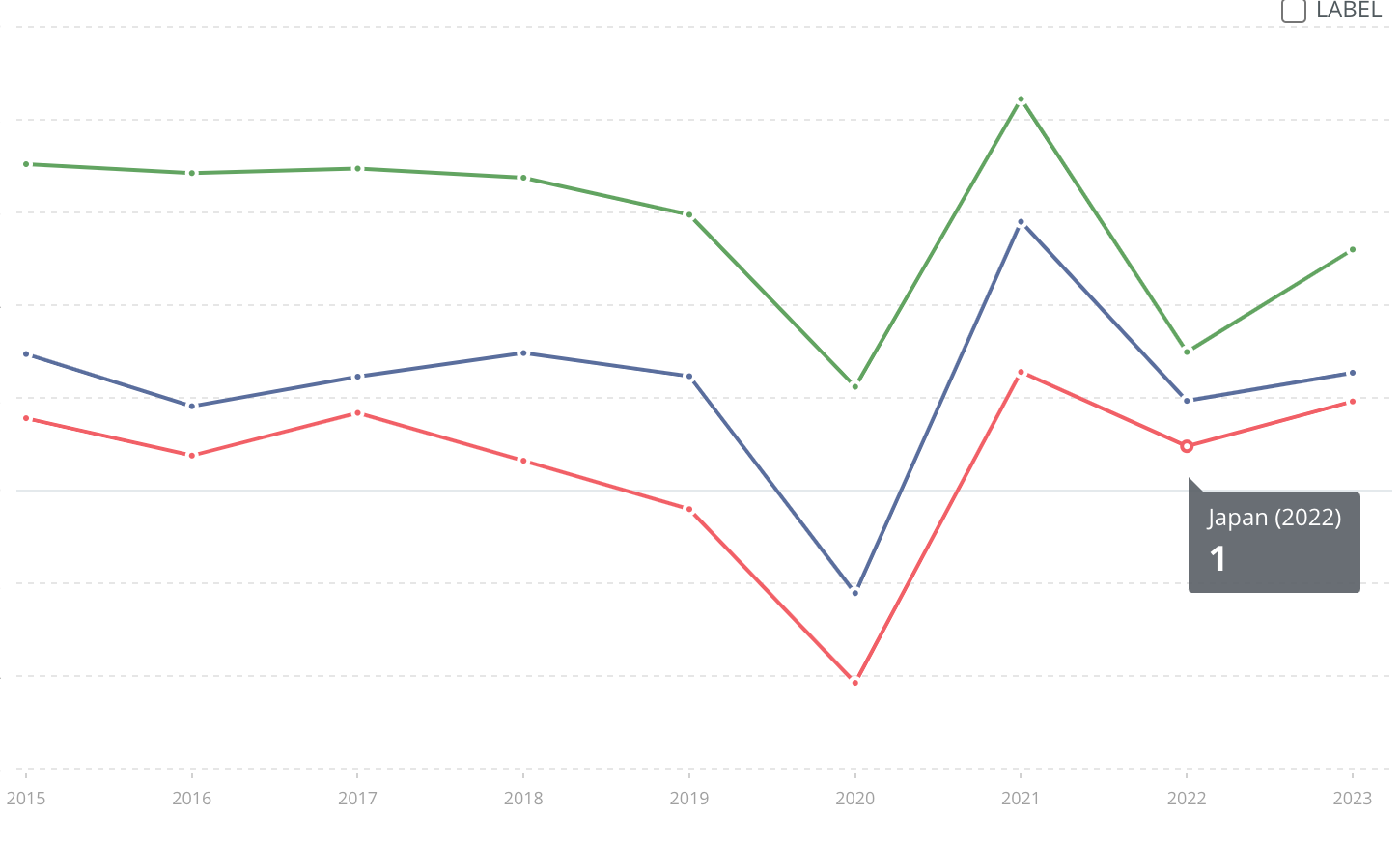

\ Japan has focused on strengthening domestic industries and supply chains. While their economic growth has always been lower than the US and China, and they took a bigger hit during COVID due to much stricter lockdowns, their economy has had stronger growth in the years since COVID than before, in contrast to the US and China whose economic growth is lower than before.

\ It may not look like much but outpacing the two biggest economies in the world is opposite to most people’s perception of Japan's economy including most of the investment community.

\

\ In addition to making dramatic changes in policies, Japan is also starting to experiment with new governance models and ways of creating new policies.

\ Anno Takahiro ran for governor of Tokyo and used git to crowd-source policy changes from voters. Version-controlled policy has been a dream of technologist since like forever. He also plugged an AI chatbot into the updated policies so people could ask questions about his platform in the upcoming election. He placed 5th with ~150k votes.

\ This style of campaign is unheard of in the West, but based on his success in a major election, I think it will catch on fast in the Japanese political sphere.

\

\ The Japanese government is also experimenting with collective decision-making with cryptoeconomic tooling such as Quadratic Voting/Funding and DAOs. Plurality Institute, a multinational economic and governance policy research group is helping Japan implement changes with their learnings from Taiwan and other markets.

\ Shibuya City, a subset of Tokyo, is proactively experimenting with how to redesign itself for more public social spaces, industry, mixed-use architecture, and other things to make it a futurist city and attract top talent.

\ Better policies, faster, with public input means faster implementation of novel solutions and accelerated economic development.

Subscribe

2. e/acc Adoption

I think Japan has a really level-headed approach to new technologies even if too conservative for me personally. They balance practicality, economic viability, scientific progress, environmental stewardship, and social issues.

Nuclear

Before a tsunami caused the Fukushima nuclear reactor meltdown in 2011 which was the biggest since Chernobyl, 30% of all energy consumed in Japan was produced via nuclear! Then it went to 0, and they are looking to go back to 20% by 2030. They are an island nation with little natural resources. Energy dependency is a major economic expense and geopolitical threat.

\ E.g. China wouldn't even have to invade Japan, just blockade them long enough until their power grid shuts down. They are ramping nuclear back up to ~20% by 2030 and investing in novel nuclear technology like modular reactors. This would put it back in the top 10-15 countries by nuclear production in the next 5 years.

\ 0 people died from Fukushima and an estimated couple of thousand were indirect deaths from evacuations and health complications. If "loss of life years" is the risk we are seeking to mitigate, Japan is losing many more life years from lack of economic development and population degrowth than even 10 nuclear meltdowns, so I'm hoping they push nuclear even harder in the coming years.

Biotech

Japan has some of the best scientific institutions and biotech manufacturing. Biotechnology Transformation (BX) for synthetic biology, biomedicine, gene and cell therapies. They excel at research, manufacturing, AND, translating to clinical treatments. Power combo.

\ They are already leading cutting-edge biotech like longevity with Yamanaka winning the 2012 Nobel Prize and Ohsumi in 2016 for medicine. I'm currently looking at starting a stem-cell injection on my next trip.

\ (The graphic included solely for the Power Rangers but the paper is good too. Japan Supremacy!)

\

\

AI

Japan has been at the forefront of AI since its inception in the 80s, including the first real-world application of expert systems. The Japanese government released the "Social Principles of Human-Centric AI" in 2019, 3 years before ChatGPT and most of the world woke up to AI ( 80s FYI) paraphrased below:

\

Dignity - AI should be used as a tool to enhance human abilities and creativity, not to control or overly depend on it.

\

Diversity & Inclusion - AI should be developed and deployed in a way that flexibly includes diverse perspectives to create new values.

\

Sustainability - Utilizing AI to generate new businesses and solutions to solve social disparities and build sustainable societies including global challenges like climate change.

\ I think these principles and their wording exemplify the well-rounded nature of Japanese e/acc policy. Highly recommend reading the AI Policy 2023 whitepaper and the 2024 retrospective from the Liberal Democratic Party. They focus on individuals acquiring AI literacy, business use cases, cultural digitization, reduce risks associated with generative AI, such as disinformation and privacy violations, while promoting the beneficial use of AI technologies in various sectors, including healthcare and climate change.

Crypto

Pretty good, and at the very least clear and understandable, crypto regulation in terms of personal/corporate finance and taxes. Unlike the US where every government agency unilaterally dictates most cryptoassets are under their purview, Japan says that cryptoassets should be treated based on their function. They have lagged behind in the industry because of bad policies related to equity investing and overregulation but they are starting to turn around on both these fronts.

\ The infamous Mt Gox hack and bankruptcy set a global precedent as the first time a companies assets weren't liquidated when a Japanese court allowed Bitcoin to be distributed directly back to depositors on the exchange. Bullish on Japan.

3. Cultural Evolution

I can’t be fucked to finish this part but Peter Thiel and some other dude have a thesis on memetic warfare. People hate being the same. Eventually, to distinguish yourself, you must consume the other. This is happening in The West with "left vs right" politics, in-fighting on irrelevant just for the sake of schizmogenesis.

\ As soon as one side says they like something, the other side HAS to label it as bad or stupid or whatever even if they never cared before just to feel different.

\ Japan’s "strong culture", insists on tradition, and has high agency as a society even if individuals don’t really. Japan will win the memetic wars of the 21st century by continuing to refine, adapt, and export its unique culture and heritage. Mother fuckers are crazy and will do ANYTHING. They are repressing their kamikaze world domination desires with squid hentai and Hello Kitty until they're ready to unload.

\ Returns are based on asymmetric bets. Ideally, you have asymmetric information informing your bets. I don’t have much asymmetric information on the Japanese market itself, just on the culture, e.g., I can speak Japanese conversationally, have friends across the country, understand how they think and act, etc. I can "move among them" even if I’m not one of them.

\ If Japan does pop off, a lot of people are going to try and rush in with their foreign attitudes and behaviors, and get completely blocked by the natives. And I'll already be fully integrated doing whatever I please.

\ Soft power and cultural domination can win over a lot. Even now, who doesn’t love Japan? Just no one wants to move there because it’s too "weird", too far, too unknown, too risky, etc. But everyone still wants to go there. With some minor changes, and proper integration programs to get the. foreigners assimilated they can transmute their cultural capital into economic capital without diluting one of their biggest advantages.

Conclusion

While people might think the market doesn’t have great prospects now, that means I can convince Japan to give me more perks for coming there at this dire time. And I know I can convince my friends to join me there. Not saying we can change the entire Japanese market but I think we could make a significant influence with just a handful of super-talented, well-capitalized rogue agents.

\ I’m also willing to bet with my background in startups/finance/entrepreneurship/art/fashion that Japan wants me to be there to help improve their economy. And I want to. So cheap house buy.

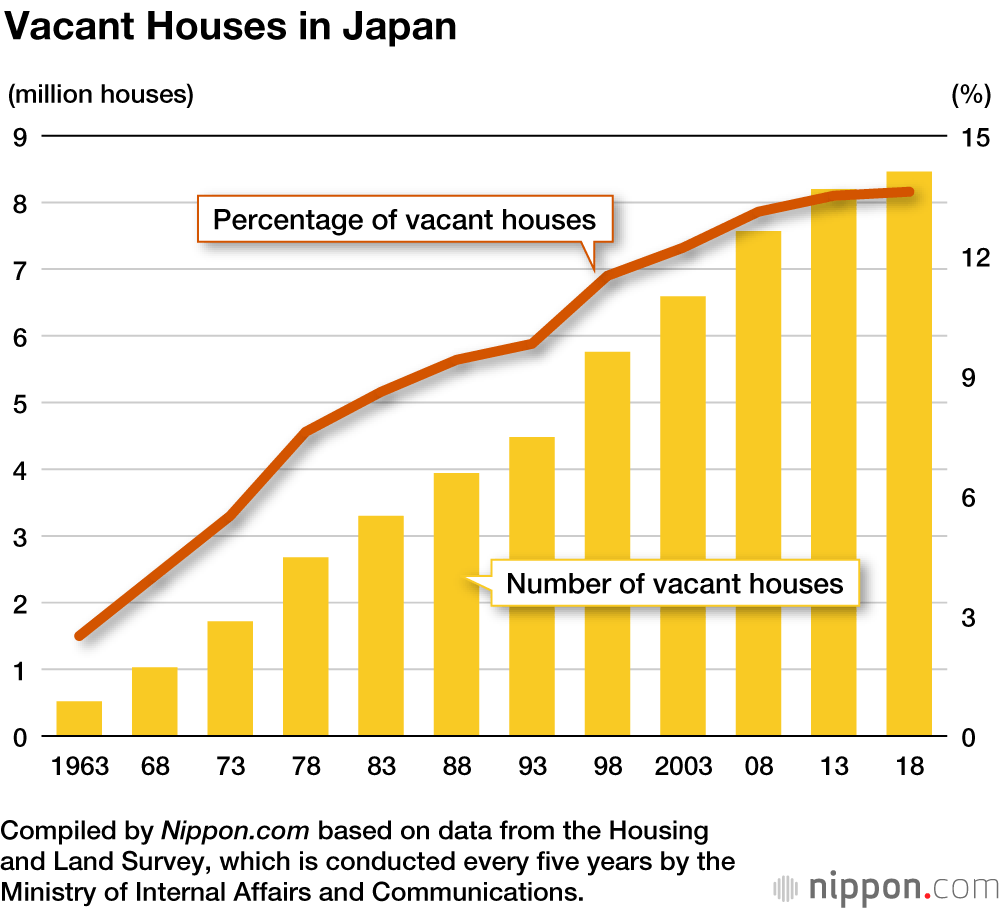

\ Apparently, the Akiya phenomenon is now known via the TikTok/Instagram algorithms to the public. To me, akiyas are a massive empty container to be filled with creative energy for the new Japanese economy. The government says akiyas are one of the biggest problems facing the country (they are wrong, it’s a symptom of other problems) and have provided incentive programs to buy these homes in the hope new residents will rejuvenate the desert countryside.

\ Approximately 12-15% of all houses (9 million!) are abandoned.

\

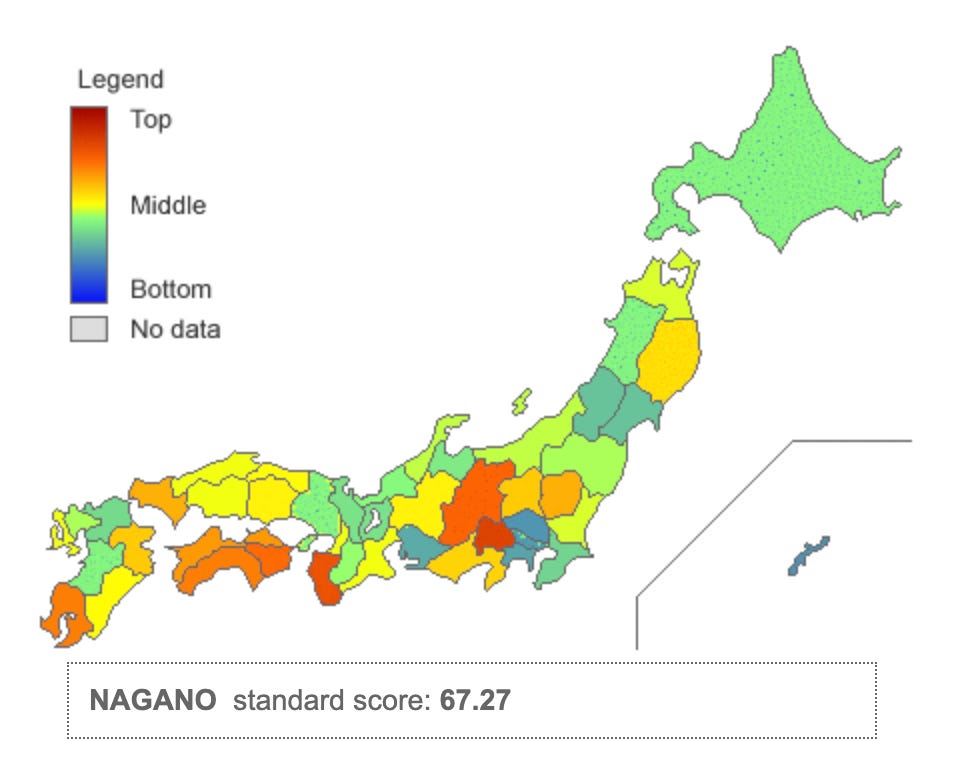

\ Nagano has one of the highest rates of akiya in the country at nearly 20% abandoned rate! I only went to Nagano for the first time to visit Akiya Collective, a project I've been following/helping for the past year. The crazy part is Nagano is known as a great vacation spot - amazing snow and ski resorts, much cooler in summer than the muggy sauna the rest of Japan turns into, beautiful mountains and clean air, and home to one of the most famous Japanese rich towns in the country Karuizawa.

\

\ I'm also looking at a place in Hokkaido with another art collective. And of course, I'm going to buy a place in my favorite spot Osaka, but I'm prioritizing the community hubs first (in general in my life and also as part of my Japanese investment thesis)

\

\

P.S. This may be only 75% of my economic thesis on Japan. I’ve at least got a “Longevity State” thesis which I’ll do another post about.

Originally posted on my dev blog Nüō Type Nation

This content originally appeared on HackerNoon and was authored by Kiba Gateaux

Kiba Gateaux | Sciencx (2024-08-07T23:21:11+00:00) e/acc, Kamikazes, Kawaii Market Crashes, and More – My Japanese Investment Thesis. Retrieved from https://www.scien.cx/2024/08/07/e-acc-kamikazes-kawaii-market-crashes-and-more-my-japanese-investment-thesis/

Please log in to upload a file.

There are no updates yet.

Click the Upload button above to add an update.