This content originally appeared on HackerNoon and was authored by Renjit Philip

The latest edition of One More Thing in AI Newsletter.

\

Technology is best when it brings people together.” – Matt Mullenweg, founder of Auttomatic and developer of WordPress.

\ Hey AI AI-curious reader,

Thank you for subscribing to the One More Thing in AI Newsletter.

\ This is specially curated for Startup founders and Business Leaders like you who want to get smarter about AI in less than 5 minutes. It is a snapshot of what I read and learned about AI in the last two weeks.

\ I hope you enjoy reading this edition. Keep learning and applying AI.

\ Best,

Renjit Philip

Goldman Sachs Experts Weigh In

Goldman Sachs has released a report on the massive spending on artificial intelligence (AI). They explore whether this huge investment will pay off. Tech companies are set to spend over $1 trillion on AI in the next few years. The report includes views from experts who are both hopeful and doubtful about AI's economic potential.

\ Key Insights and Arguments

\

Doubts About AI’s Economic Impact Daron Acemoglu (MIT) thinks the benefits from AI will be smaller than expected. He predicts only a 0.5% increase in productivity and a 1% increase in GDP over the next ten years. He believes AI won't bring significant changes quickly and doubts it will be cost-effective in automating many tasks soon.

Jim Covello (Goldman Sachs) says AI needs to solve very complex problems to justify its high costs. He is skeptical that AI will ever be cheap enough to replace many tasks affordably.

\

Hopes for AI’s Potential Joseph Briggs (Goldman Sachs) is more optimistic. He predicts AI could automate 25% of all work tasks, leading to a 9% increase in US productivity and a 6.1% GDP growth over the next decade. He believes the cost savings and the trend of technology becoming cheaper support a positive long-term impact of AI.

Kash Rangan and Eric Sheridan (Goldman Sachs) are excited about AI’s potential, even though there hasn't been a clear "killer application" yet. They believe current spending on AI infrastructure is reasonable and expect long-term benefits as AI becomes more integrated into different industries.

\

Challenges and Constraints Chip Shortages: Analysts warn that chip shortages, especially in High-Bandwidth Memory technology, will limit AI growth in the near future.

Power Supply Issues: Analysts highlight that the rise in power demand from AI and data centers could strain the US power grid, potentially limiting AI’s growth.

\ Market Implications AI Bubble Concerns: Despite doubts about AI’s fundamental value, some experts caution that the AI bubble could last for a while, benefiting infrastructure providers. Utilities might be the next big winners.

\ Long-Term Equity Returns: Only the most favorable AI scenarios, where AI boosts growth and profitability without increasing inflation, will result in above-average long-term returns for the S&P 500.

\ Takeaway The report presents a balanced view, acknowledging both AI investments' potential and challenges. While there is hope for AI’s transformative power and long-term benefits, there are concerns about immediate economic impacts, technological constraints, and market sustainability. This analysis shows the complexity and uncertainty of AI’s future economic contributions. It's worth a read for business leaders!

The AI $600B Gold Rush: Where to Next?

AI is making waves, and everyone's wondering how it will shape the future. Let’s dive into the latest insights from Sequoia Capital.

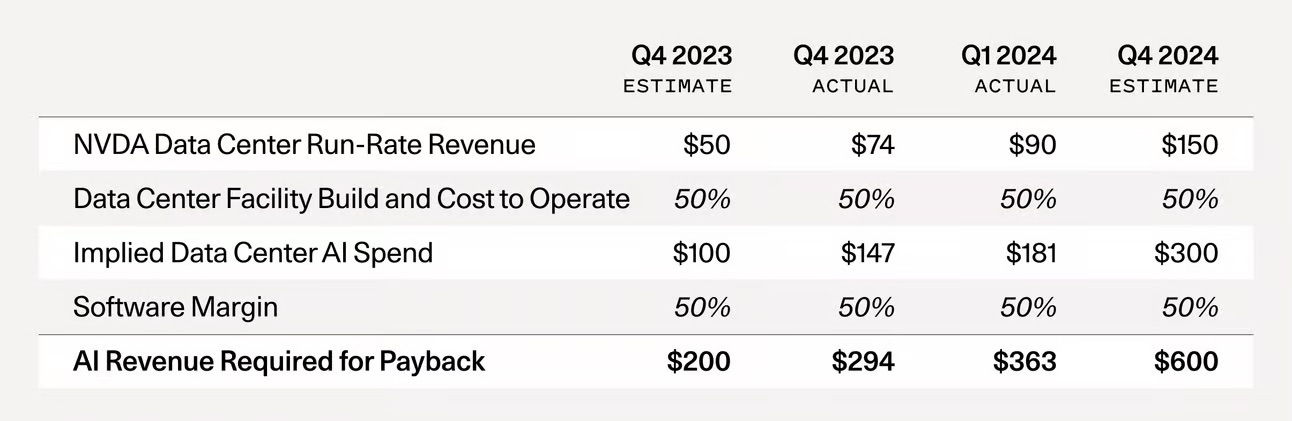

\ But the real question is, where's the money going? For every dollar spent on a GPU, another dollar is needed for energy to run it in a data center. If Nvidia makes $50B from GPUs by the end of the year, data center costs will be about $100B.

\ Companies using these GPUs, like Starbucks or Tesla, must make a 50% profit margin (assume that margin, which is a reasonable average). So, for every $50BN worth of chips sold, the companies need to create $200BN worth of revenues to make the purchase viable.

\ The actual gap is $600BN.

\

(Image from Sequoia’s blog)

\ Takeaways from the post:

\ Supply shortage has subsided: Late 2023 was the peak of the GPU supply shortage. Startups were desperate for GPUs, but now, it's much easier to get them with reasonable lead times. GPU stockpiles are growing: In Q4, Nvidia reported that about half of its data center revenue came from large cloud providers, with Microsoft alone likely contributing 22%. Hyperscale CapEx is at historic levels, and Big Tech is heavily investing in GPUs. Stockpiling hardware continues, and a reset will occur when stockpiles are large enough to reduce demand.

\ OpenAI still leads AI revenue: OpenAI’s revenue reached $3.4B, up from $1.6B in late 2023. Most startups are still far behind, with revenues under $100M. AI companies need to deliver significant value to consumers to justify ongoing expenses.

\ Lack of Pricing Power: Unlike physical infrastructure like railroads, which can charge more because there can only be so many tracks, GPU data centers can’t do that. GPU computing is becoming a cheap, hourly service. More companies keep building AI clouds, stopping any single company from controlling prices, so prices drop, like in the airline industry.

\ Investment Losses: Investing in new technologies often leads to big losses. History shows that during technology booms, many people lose money, like with railroads. It’s easier to see which investments will lose money than which will win. Depreciation: Technology like GPUs gets better quickly. Nvidia will keep making better chips, like the B100, which will make current chips lose value fast. People overestimate how long current chips will stay valuable, unlike railroads, which don’t get better as quickly.

\ Last word: Winners vs. Losers: There are always winners, even when there’s too much “building” fuelled by VC money. AI is expected to be the next big thing. Lower GPU costs are suitable for new ideas and startups.

\ While investors might lose money, AI company founders will likely succeed due to lower costs and the lessons learned during this time. Forget about the current costs of AI training and GPUs and start building solutions that add value to end customers. It is still early days of AI.

This is an excerpt from my newsletter published on the web at www.onemorethinginai.com

This content originally appeared on HackerNoon and was authored by Renjit Philip

Renjit Philip | Sciencx (2024-10-01T23:53:05+00:00) Where’s the AI Revenue? Plus, Will the Trillion-Dollar AI Gamble Pay Off?. Retrieved from https://www.scien.cx/2024/10/01/wheres-the-ai-revenue-plus-will-the-trillion-dollar-ai-gamble-pay-off/

Please log in to upload a file.

There are no updates yet.

Click the Upload button above to add an update.