This content originally appeared on HackerNoon and was authored by Obyte

Crypto trading is undoubtedly surrounded by some bad myths in each extreme, good and bad. Some say it’s a bulletproof way to be a millionaire, while others outright claim that it’s nothing more than a scam. None of them are right, though. Crypto trading is a legitimate practice, but it involves financial risks. Also, there are fake crypto trading platforms, making empty promises to their victims.

\ This practice occurs when someone is buying and selling cryptocurrencies like Bitcoin or Ether to make a profit, usually by taking advantage of price changes. A crypto trading platform is a website or app where traders can exchange these digital currencies. These platforms provide tools to check prices, make different types of trades, and manage funds, enabling beginners and experts to participate in the cryptocurrency market.

\ There are other platforms in which the trading is automated, which means you’re not expected to do much besides providing funds. They use algorithms, bots, or professional managers to trade on your behalf —and they’re considered riskier for it. Remember that if you don’t own your private keys in crypto, you don’t have real control over your coins. But there are some additional signs you can check before pouring money into what seems a promising investment.

Alarm signs

Are they asking you only $250 to start and promising fixed monthly returns of 30, 60, 150, or whatever good-looking percent? That’s the first thing that will tell you to abandon this site ASAP because it’s an obvious scam. Genuine crypto trading platforms will, at least, try to educate you in the matter, and won’t hide the fact that this practice involves high financial risks.

\ There’s no such thing as ‘fixed’ returns in crypto trading because this market is highly volatile and unpredictable. Profits are real, losses are also very real. Legitimate crypto trading involves inherent risks, and any claims of consistent, fixed profits should be approached with skepticism. Don’t invest anything you’re not prepared to lose —that’s a general rule.

\ Another major red flag is a lack of transparency. If the platform of your choosing claims to be managed by a (centralized) company of experts but there’s no physical address, no customer support, no real means of contact, and the team is anonymous, it’s harder to hold them accountable. Legitimate brands provide clear contact details and team information to build trust and credibility.

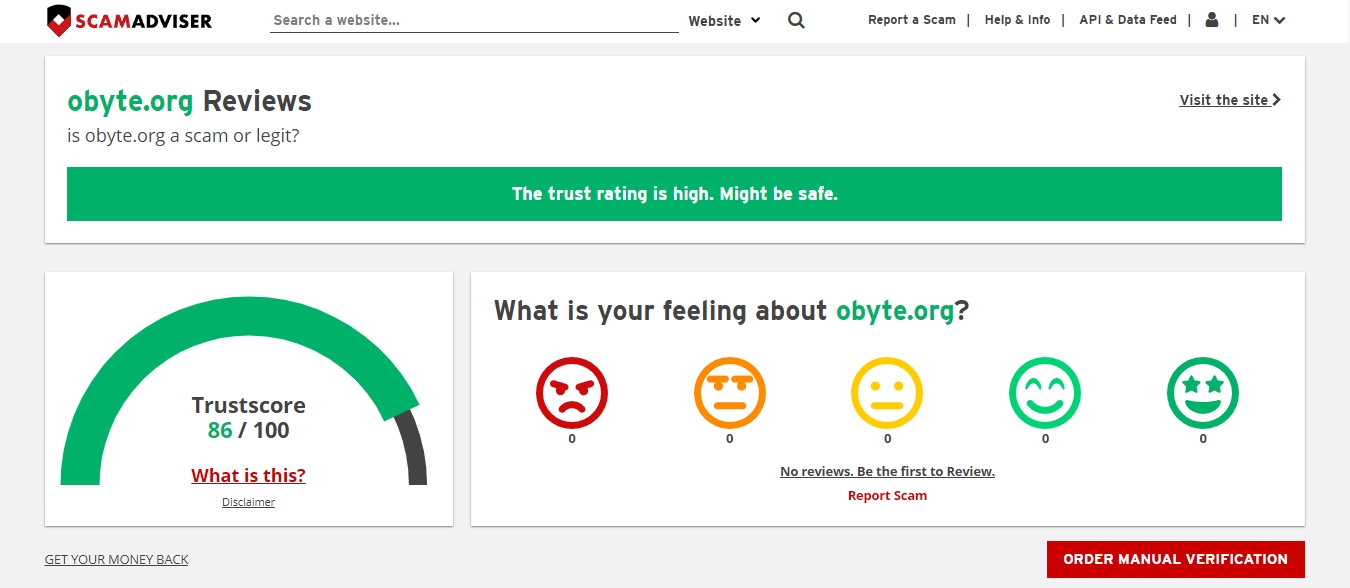

\ In any case, reputation platforms like TrustPilot and ScamAdviser could also be useful. Just type the name or URL of the investment brand/website there, and see the results.

\

\ Additionally, be cautious if their website displays poorly written content, broken links, or an overabundance of generic awards and testimonials. Lastly, scrutinize the platform’s payment methods and promises. Scammers often avoid bank transfers, pushing you to send cryptocurrency instead, which is harder to trace and reverse. However, legitimate businesses also might have good reasons to work with cryptocurrencies only, so always consider the whole picture.

How to start safely with crypto trading?

No matter if your platform of choice is automated or not, you’ll need to educate yourself first —or you’ll be easy prey for scammers and market swings. Starting with crypto trading can feel overwhelming, but understanding the basics helps. First, research the cryptocurrencies you want to trade, in order to learn how they work and what influences their prices. Next, look for legitimate platforms that offer beginner-friendly interfaces, tutorials, and demo accounts to practice trading without risking real money.

\ You should also learn about different trading strategies. Beginners could focus on spot trading, where you buy and sell real cryptocurrencies at current market prices, before exploring advanced methods like futures or margin trading. Start with small investments and remember the rule: never trade more than you can afford to lose. Diversify your investments across multiple cryptocurrencies to manage risks better.

\

Finally, prioritize security. Enable multi-factor authentication on your trading account, use strong passwords, and never share private keys. Educate yourself using reliable sources, and prefer decentralized platforms once you're a more advanced user.

\ In Obyte, a fully decentralized ecosystem, you can find several trading platforms to apply your own strategies. For instance, Oswap.io is a DEX that offers 32 pools (shared liquidity reservoirs), including the pairs GBYTE-ETH, GBYTE-WBTC, GBYTE-USDC, and more. Last year, we also launched the Pythagorean Perpetual Futures: future contracts in the form of tokens that never expire, tied to bonding curves to offer automated liquidity. Since there are no middlemen here, you can retain full control of your funds while trading!

\

Featured Vector Image by Freepik

\

This content originally appeared on HackerNoon and was authored by Obyte

Obyte | Sciencx (2025-02-17T09:29:37+00:00) Here’s How to Spot a Fake Crypto Trading Platform. Retrieved from https://www.scien.cx/2025/02/17/heres-how-to-spot-a-fake-crypto-trading-platform/

Please log in to upload a file.

There are no updates yet.

Click the Upload button above to add an update.