This content originally appeared on HackerNoon and was authored by Obyte

\ Cryptocurrencies aren’t as new as they were some years ago, but they surely maintain the vibe of a novel and complex concept for regulators worldwide. Therefore, laws and rules around these assets are still a work in progress everywhere, with some already present, some others yet to come, and some more evolving along the way.

\ Year to date, several jurisdictions have put their two cents on the matter, changing the rules for a lot of crypto users and companies on their territories. It’s always important to keep up to date with these developments, considering that they could affect us and our crypto funds directly. Let’s then find out some remarkable regulatory updates for the crypto industry worldwide in 2024 —so far.

\

Stablecoins and MiCA

The Markets in Crypto-Assets (MiCA) regulatory framework isn’t exactly new, having been proposed in 2020 and approved in 2023 for all the European Union state members. However, this year is fundamental for its lifecycle, being the implementation phase and the entry into application from December 2024.

\ This regulation serves as a comprehensive guide for crypto asset service providers (CASPs) in the EU, aiming to strike a balance between encouraging innovation and safeguarding investors. Licensed financial entities must inform their national authorities about their crypto activities, while unlicensed entities face a rigorous authorization process. MiCA also ensures CASPs manage client complaints effectively by requiring clear, accessible, and annually reviewed procedures, adequate resources, and skilled personnel to handle issues promptly and fairly.

\ Needless to say, CASPs — by definition — are centralized entities, even if they work with decentralized cryptocurrencies or crypto platforms.

\

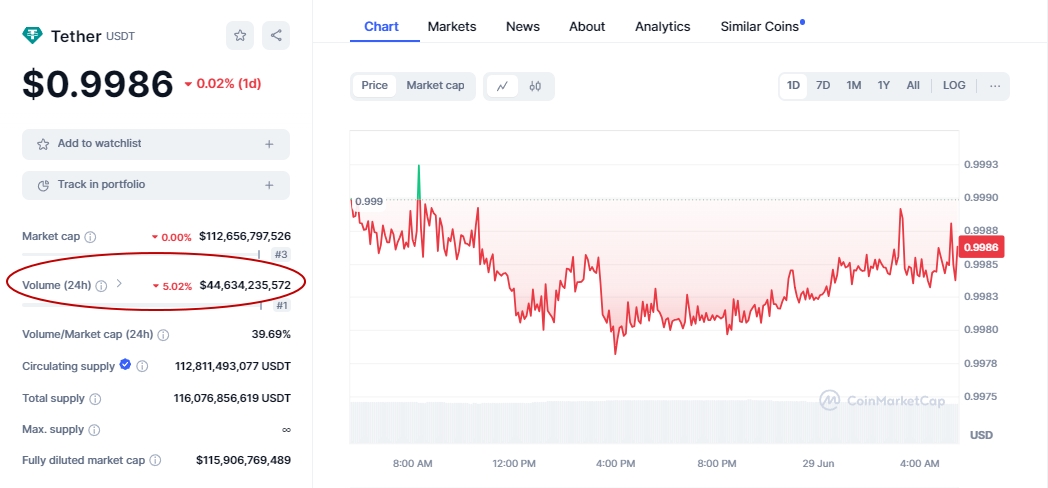

A critical point of the law involves stablecoins, of course, and has caused concerns among major providers —namely Tether (USDT) and USD Coin (USDC). **Under MiCA, stablecoin issuers not tied to European currencies must cease issuance if daily transactions exceed €200 million, to prevent private entities from encroaching on the euro’s role. Both USDT and USDC, for instance, widely surpass that daily limit.

\

\ As a result, several crypto exchanges have started to delist this asset for their EU customers, while Tether expects them to use it as a transactional gateway and don’t allow direct exchanges with fiat. The specific MiCA’s rules for stablecoins started to take effect on June 30, 2024.

\

Against a USD CBDC and surveillance

Central Bank Digital Currencies (CBDCs) can be a touchy topic for a lot of people. Some of them (not even all of them) are, technically, cryptocurrencies in the sense of being built with Distributed Ledger Technology (DLT) and available to transact worldwide. However, they’re also coins completely controlled by governments, and surveillance and censorship concerns around them have arisen more than once.

\ According to the Atlantic Council, "134 countries & currency unions, representing 98% of global GDP, are exploring a CBDC," but most of them are in research or pilot phases, and only three have successfully launched one until May 2024. The other 17 are inactive, and at least two projects were canceled. The United States joined this year as the third canceled project because the House of Representatives passed a bill prohibiting the Federal Reserve from issuing a USD CBDC. This would make the United States the first country to outright ban its own (potential) CBDC due to surveillance concerns.

\n

\ There have been reports of deceptive practices and data breaches, raising further questions about the project’s security and ethical implications. That’s why it’s been questioned by regulators from over ten countries, and directly banned in Kenya, Portugal, Spain, Hong Kong, and probably Italy.

\

FIT21 and self-custody in the US

\ Besides the ban against CBDC, regulators in the US have been very busy this year. Probably one of the biggest developments surrounding cryptocurrencies has been the Financial Innovation and Technology for the 21st Century Act (FIT21). This bill establishes a clearer regulatory framework for digital assets and gives the Commodity Futures Trading Commission (CFTC) authority over decentralized digital assets and the Securities and Exchange Commission (SEC) authority over centralized ones.

\ In other words, the CFTC would handle digital commodities (most cryptos), while the SEC would oversee only the ones considered securities. New and clear definitions would be put in place for every industry player to know whose rules will be followed. FIT21 was approved by the House of Representatives in May. The next steps for the bill to become law include passage in the Senate, where it will face further scrutiny, and then it must be signed by the President. The Biden administration has expressed opposition to the bill but has not threatened to veto.

https://x.com/jchervinsky/status/1793398130269954346?embedable=true

\ On the other hand, serious concerns about self-custody wallets have been nagging enough for several providers to leave the country and its citizens. Acinq, Phoenix, and Wasabi have withdrawn from the US, while the Department of Justice (DOJ) has accused Samourai Wallet founders of money laundering because of that software —just like they previously accused Tornado Cash founders. Likely as a reaction to it, the states of Oklahoma and Louisiana passed their own bills to protect crypto self-custody rights in their jurisdictions.

\

AML/KYC and new licenses

Back in 2021, as evidenced by a crypto regulation report, most countries worldwide were already applying AML/KYC rules and procedures for cryptocurrency exchanges. The number has been only increasing over the years, and, sometimes, new related regulations have been added to the first ones. This can be boiled down to properly identify customers for all crypto companies, and crypto users being obligated to share their identity and documents when trading against fiat currencies.

\

In addition, stricter requirements and licenses have been appearing for cryptocurrency service providers. That’s the case in Türkiye, where their Parliament approved the Bill on Amendments to the Capital Markets Law in June 2024. This framework now mandates that crypto asset service providers obtain permission from the Capital Markets Board (SPK) for establishment and operation, with technological criteria set by TÜBITAK (Turkey's Scientific and Technological Research Council). It introduces definitions for crypto assets and service providers, requires independent financial audits, and imposes strict penalties for unlicensed operations.

\ Other countries, for their part, have been placing or adjusting their own AML regulations for cryptocurrencies this year. Among them, we can count Singapore, Argentina, Kenya, Taiwan, India, Costa Rica, and even the European Union. In the last case, they’re aiming for stricter measures, where crypto asset service providers will need to apply the same AML rules as banks for transactions of over €1,000. At the very least, they explicitly don’t impose these rules on self-custody wallet providers.

\

Crypto bans come and go

As of September 2023, according to the Atlantic Council, there were at least 9 countries with a general ban placed against cryptocurrencies. One of them was Bolivia, and there’s actually good news about it. In June 2024, the Central Bank of Bolivia (BCB) lifted its 4-year ban on cryptocurrency transactions, allowing financial entities to engage with crypto under new regulations.

\

This decision, made in collaboration with the Financial System Supervisory Authority (ASFI) and the Financial Investigations Unit (UIF), follows the recommendation of the Latin American Financial Action Task Force (GAFILAT) to regulate Virtual Asset Service Providers in the country. The BCB aims to modernize the country’s payment system, enhance financial infrastructure, and promote digital financial inclusion.

\ On the opposite side, the Central Bank of the United Arab Emirates (UAE) discussed the issuance of payment token services regulations aimed at licensing stablecoins, mandating that such tokens be backed by UAE dirhams and not linked to other currencies. For the crypto lawyer Irina Heaver, this could imply a practical ban on crypto payments within the country. The results of this discussion and subsequent comments are yet to be seen, though.

\

Obyte as a safe place

We can say that Obyte, built on a Directed Acyclic Graph (DAG) system, positions itself as a robust platform resistant to surveillance, seizure of funds, and censorship attempts. Unlike blockchain structures, Obyte's DAG architecture without miners allows for fully decentralized data storage and transaction validation, making it inherently resistant to centralized control.

\

\ This setup ensures that no single entity can disapprove, seize, or censor transactions, preserving user autonomy and offering privacy features. The platform’s focus on user control is further reinforced by its use of human-readable smart contracts that execute autonomously without the need for intermediaries or coding, reducing vulnerabilities to censorship efforts.

\ By leveraging its DAG technology, Obyte enhances decentralization and autonomy, making it a potentially safer ecosystem for users concerned about privacy and security. This combination of features positions the ecosystem as a promising solution for those seeking a crypto platform that prioritizes user control and resilience against external interference.

\

Featured Vector Image by Freepik

\n

This content originally appeared on HackerNoon and was authored by Obyte

Obyte | Sciencx (2024-07-22T13:07:47+00:00) Crypto Regulation in 2024: 5 Key Updates You Need to Know. Retrieved from https://www.scien.cx/2024/07/22/crypto-regulation-in-2024-5-key-updates-you-need-to-know/

Please log in to upload a file.

There are no updates yet.

Click the Upload button above to add an update.