This content originally appeared on HackerNoon and was authored by Fundright

The European investment environment in 2024 is marked by a surge of exciting and promising sectors that are capturing the attention of venture capitalists and investors alike. According to the Venture Pulse Report by KPMG, the European venture capital market experienced a significant increase in activity in the second quarter of 2024, with investments rising from $13.9 billion to $17.8 billion across 1,869 transactions. This growth was primarily driven by mega deals involving companies like Wayve, Abound, Mistral AI, and Monzo. As we navigate through this evolving ecosystem, understanding the sectors poised for substantial growth and innovation is crucial for making informed investment decisions.

\ In this article, we will delve into the most promising investment sectors in Europe for 2024, exploring the driving trends and key factors that make these sectors attractive to investors.

Understanding Where to Invest

Let's consider the criteria to keep in mind when making investment decisions. Investors should evaluate market trends, global demand, sustainability, and the sector's resilience during economic downturns. Analyzing these factors helps in identifying sectors poised for growth and innovation.

\

- Market Trends: Observing industry developments and forecasting future trends.

- Global Demand: Identifying sectors catering to growing global needs or potential markets.

- Sustainability: Investing in sectors contributing positively to environmental and social goals.

- Economic Resilience: Choosing sectors that remain in demand irrespective of economic conditions.

\ By considering these factors, let's explore the most interesting investment sectors for 2024.

Top Sectors for Investment in 2024

Fintech

Overview: Fintech encompasses technological innovations in financial services, including digital payments, blockchain, and online lending.

\ Current Trends: In the first half of 2024, the global Fintech sector navigated a challenging investment environment. According to Innovate Finance, global Fintech investments during this period amounted to $15.9 billion across 1,566 deals.

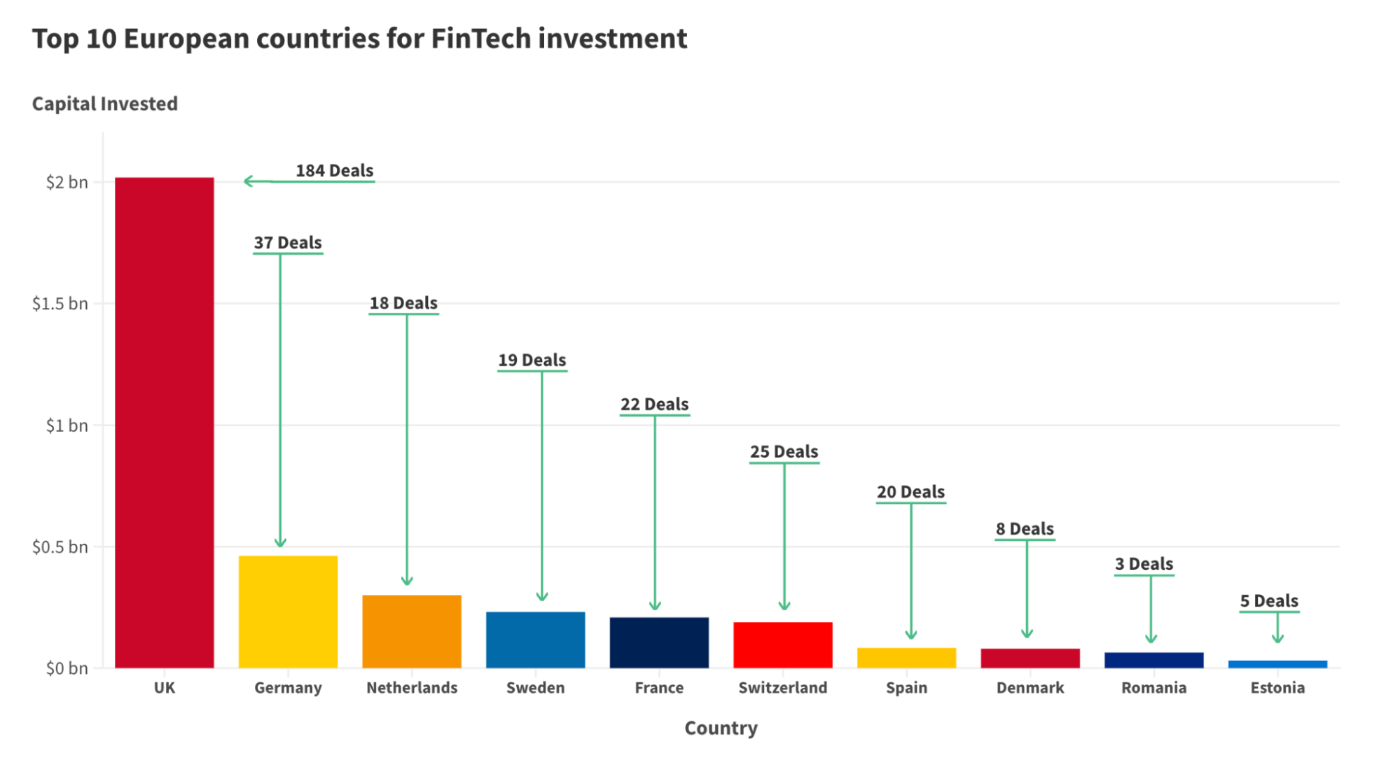

\ During the first half of the year, the UK secured $2.0 billion in investments through 184 deals, surpassing the rest of Europe’s total of roughly $1.8 billion. This demonstrates the UK's ongoing leadership in the European Fintech sector, despite global economic and political uncertainties.

\ Germany and the Netherlands emerged as the second and third-largest markets, underscoring the rising significance of tech hubs across continental Europe. Sweden remains a key player, while France also ranks among the top five, indicating its strong position as a hub for financial technology innovation.

\

\ Notably, 167 of these deals were under $20 million, focusing on Seed and Series A stages. The average deal size was $10.2 million, down from the $12 million average in 2022 and 2023, indicating a shift back towards early-stage ventures.

\ Why It’s Attractive: The fintech sector is at a critical inflection point, with innovations in digital banking, blockchain, and financial inclusion driving growth. The sector's adaptability to regulatory changes and consumer preferences ensures a robust investment outlook.

Artificial Intelligence (AI)

Overview: AI continues to shine in 2024, driving innovation across various industries, from healthcare to finance.

\ Current Trends: According to PitchBook, AI investments in Europe doubled from the previous quarter to €4.2 billion in Q2 2024. Overall, AI companies attracted €6.3 billion in the first half of the year. The integration of AI in various sectors has demonstrated its transformative potential, from enhancing operational efficiencies to pioneering new product developments.

\ The UK remains at the forefront of the European AI scene, with the highest number of VC-backed AI and machine learning (ML) companies. With 1,319 startups, the UK surpasses France, which holds the second spot with 520 companies. This leadership is evident in the substantial deal values and volumes attracted by AI companies in the UK.

\ Why It’s Attractive: AI's ability to revolutionize industries and its rapid adoption make it a top investment choice. AI technologies, including machine learning, natural language processing, and robotics, are expected to continue driving significant advancements and creating substantial economic value.

3. SaaS and B2B

Overview: SaaS (Software as a Service) and B2B (Business-to-Business) solutions focus on providing software and services to businesses, enhancing operational efficiency and productivity.

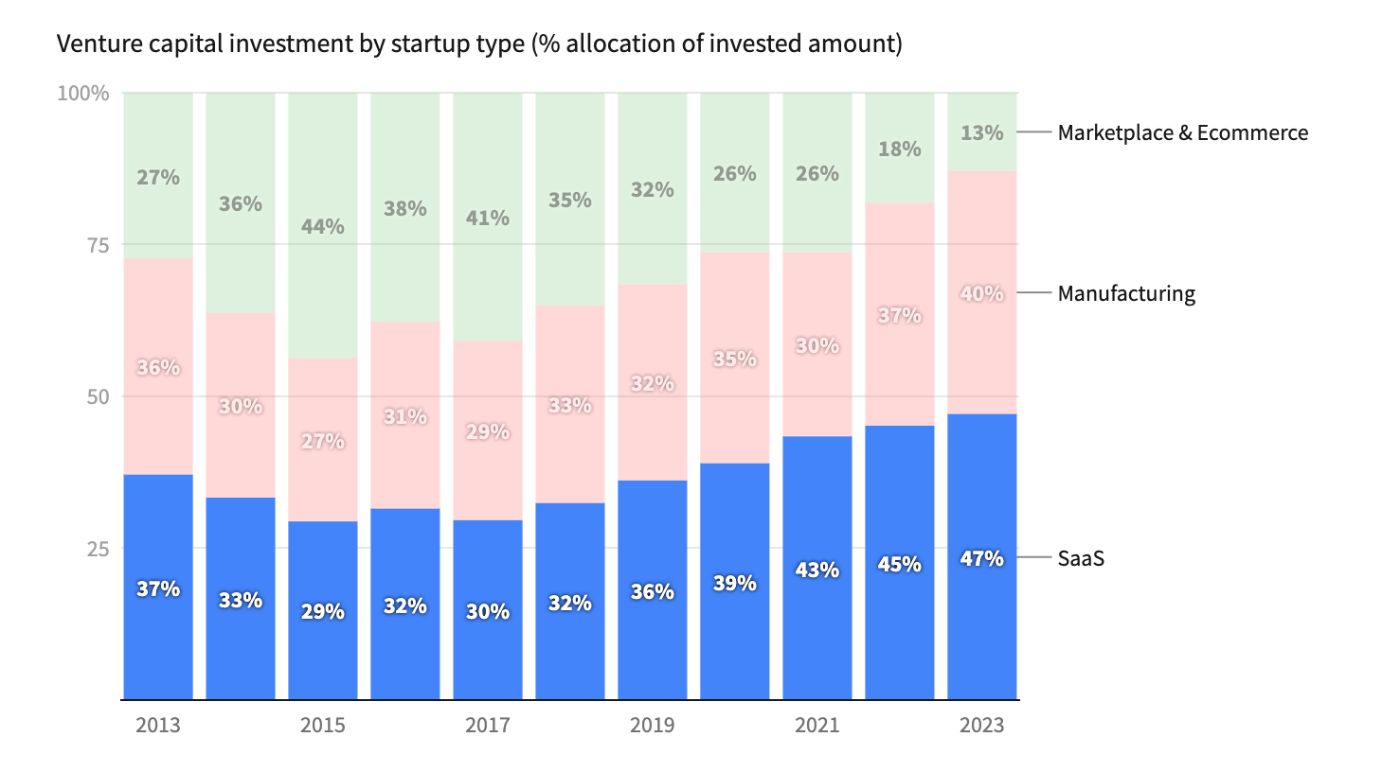

\ Current Trends: In recent years, SaaS and B2B solutions have become increasingly prominent in the venture capital landscape. According to Dealroom, 47% of venture capital investments in 2023 were directed towards startups with a SaaS business model, accounting for nearly half of all venture capital funding. This represents a significant increase over the past decade, highlighting a sustained and accelerating trend towards SaaS-focused investments.

\ \ Why It’s Attractive: The scalability and recurring revenue models of SaaS and B2B make them attractive for investors. The continuous need for businesses to streamline operations and adopt digital solutions drives growth in these sectors.

4. Cybersecurity

Overview: Cybersecurity is crucial for protecting information and systems from cyber threats, with increasing importance due to the rise of digitalization.

\ Current Trends: According to PitchBook’s report on the sector, investments in cybersecurity reached $9.6 billion across 693 deals in 2023, with top-performing companies commanding high valuations.

\ Last year, cybersecurity unicorns saw exceptional valuation growth, outpacing many other emerging tech sectors. Leading companies are still attracting substantial valuations despite a slowdown in venture capital funding. Wiz reached a $10 billion valuation in February following a $300 million Series D round. In November, Keyfactor achieved a $1.3 billion valuation, and Prove Identity crossed the $1 billion mark in October.

\ Why It’s Attractive: The growing frequency of cyber threats and the need for robust security measures drive the demand for cybersecurity solutions. The sector's critical role in protecting data and systems makes it a compelling investment choice.

5. Climate Tech

Overview: Climate tech focuses on developing technologies to combat climate change and promote sustainability.

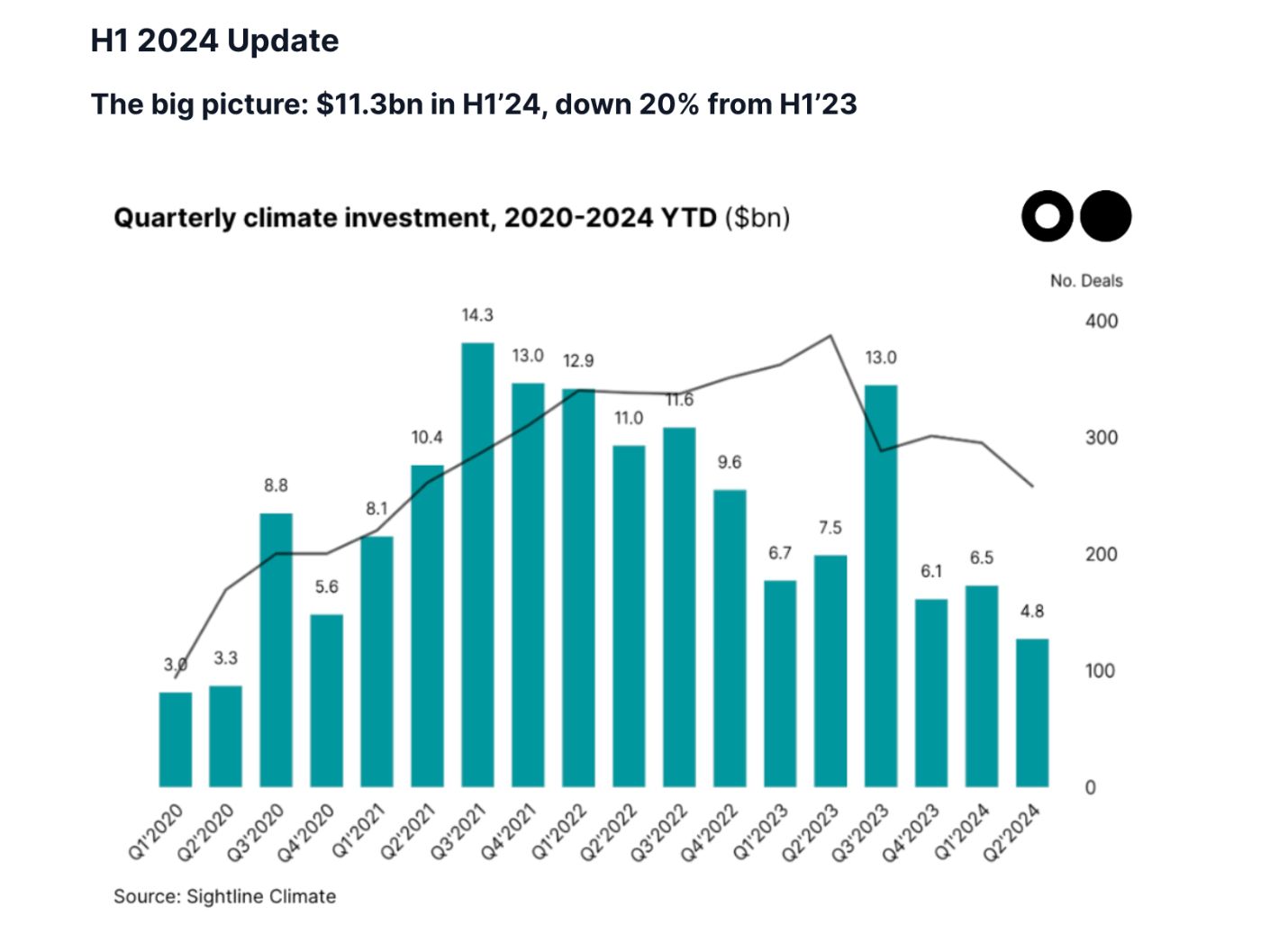

\ Current Trends: Climate tech investments totaled $11.3 billion in H1 2024, despite a 20% decline from the previous year. The sector continues to attract attention with innovations in energy, sustainable materials, and carbon management.

\ Why It’s Attractive: Climate tech aligns with global sustainability goals, offering long-term growth potential. Investments in renewable energy, sustainable agriculture, and green technologies position the sector as a key player in addressing environmental challenges.

\

:::info The information provided in this article is for informational purposes only and should not be considered as financial advice. The content does not constitute investment recommendations, and we do not assume any responsibility for any financial decisions made based on this information.

:::

\

This content originally appeared on HackerNoon and was authored by Fundright

Fundright | Sciencx (2024-08-26T07:14:06+00:00) Most Promising and Exciting Investment Sectors in Europe in 2024. Retrieved from https://www.scien.cx/2024/08/26/most-promising-and-exciting-investment-sectors-in-europe-in-2024/

Please log in to upload a file.

There are no updates yet.

Click the Upload button above to add an update.