This content originally appeared on HackerNoon and was authored by 1uc4sm4theus

Venture capital, or VC (also known as risk capital), is a type of investment typically aimed at early-stage companies that are small to medium-sized. These companies often include startups, which may have little to no revenue yet. Because of this, they require substantial funding to carry out their operations, making this a high-risk investment model. Venture capitalists essentially bet on the potential of these startups, hoping their resources will grow in value as the company succeeds.

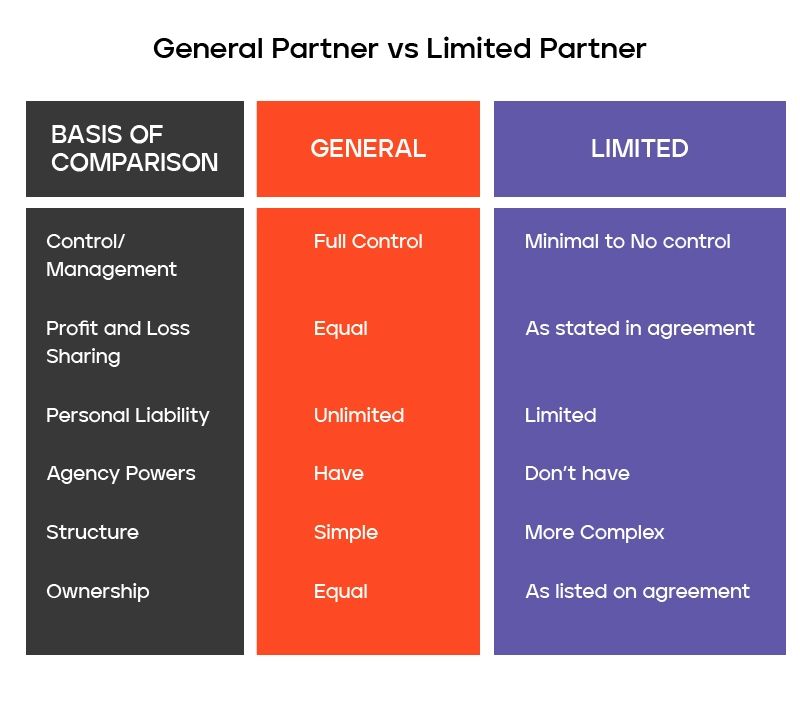

\ Venture capital investments can generally be categorized into two types, each depending on the responsibilities, rights, and obligations of the company's founders and investors:

\

General Partner (GP) – All investors share equal authority in deciding the company’s strategies.

Limited Partner (LP) – Not all participants have the same level of involvement; some contribute financially, while others focus on management and operations.

\ When a startup founder seeks venture capital investment, one of the first steps is to determine how much equity each shareholder will hold, how involved investors will be in day-to-day operations, and what level of power and responsibility each party will have. It’s worth noting that venture capital investments are generally aimed at fostering rapid growth within the company. Unlike traditional investments, it's not always necessary to have a fully developed product already on the market. However, investors will evaluate a variety of factors before deciding whether to invest in an idea or product. Some of these factors may be prioritized more than others when it comes to high-risk investments.

\

- The Management Team

A strong team and solid leadership are critical in determining whether a company has the structure necessary to move forward with its work or ideas. Even if the startup is small, which is common in the early stages, the interaction among team members, their experience, and their skill sets are of utmost importance. One of the key factors is the ability to execute: it's not a dealbreaker if a startup doesn’t yet have a product; the idea can be promising, but what truly differentiates a good investment is the commitment and execution capability of the team. Ideas are plentiful, but not many have the technical skills and drive to make them a reality. For instance, some companies have managed to carve out significant market space, even in competitive industries, thanks to the collaboration and technical expertise of their team. Moreover, a strong leader is essential to harness the strengths of each team member to achieve the company's goals.

\

- The Business Model

Now, this part can get a bit tricky. Creating a sustainable business model might seem straightforward on paper, but in reality, it can be a real challenge. While a model might look great in theory, it can completely fall apart when put into practice. Today, there are plenty of tools and examples of business models that can be used for inspiration when building your own. It’s important to note that the real appeal of investing in a business model doesn’t necessarily lie in how it functions. Below are a few key factors that are often considered:

Scalability

Viability

Competitive

Differentiation

Scalability and viability are crucial indicators of whether a business has the potential to expand, alongside how easily the business model can be replicated. Essentially, a scalable business is one that can increase its production, profitability, and operations without compromising efficiency and returns. If a business is scalable, replicating it becomes significantly easier. Replicability refers to a company’s ability to recreate a successful business model across different locations and markets. Depending on the business context, these factors can serve as significant competitive advantages and are definitely sought after by investors.

\

By highlighting these aspects, both founders and investors can better understand what makes venture capital investments unique, as well as the key components that are analyzed before funding a startup.

\ 3. Product Value

A key aspect of venture capital investment is the value of the product being developed. Recently, I came across a book by Tony Fadell, an American software engineer and investor known for his work on the iPod, titled Build. In this book, Fadell provides a practical and clear guide to creating products that have real value. It's a great resource for anyone looking to build a career in product management and development, offering insights on not just how to build a successful career but also how to create something that adds genuine value to users. I first heard about this book through a news article on Google Ventures (now GV), a firm known for its investment in high-value products like GitLab, Stripe, Verve, and others—all widely used across various industries.

\

\ It’s crucial for any envisioned product to hold value both for its user base and the broader community. Take GitLab, for example—it's a repository tool designed by developers for developers, making a significant impact within its target audience. Even a product that may seem small or niche has a great potential to grow if it can make a difference to its users. However, while creating a product that delivers value may sound simple and obvious, executing this in practice is often far more challenging than it initially appears.

\ Ensuring a product’s value is not just about features and functionality; it’s about understanding user needs and creating something that stands out in a way that matters to its intended audience. In the context of venture capital, a valuable product can significantly increase a company's potential for rapid growth, which is precisely what investors are looking for.

Choosing the Right Technology

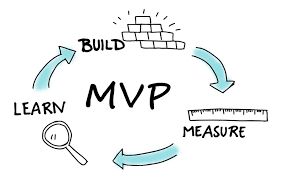

Choosing the right technology is crucial and can determine how valuable a company becomes, both in its early years and in the future. When I talk about technology, I don't just mean software development technologies like programming languages and frameworks, but also the tools that will help scale the business and build an MVP (Minimum Viable Product).

\ Companies like Facebook and Twitter adopted web frameworks that allowed them to build a demonstrable product quickly. The ease provided by programming languages like Ruby and PHP was extremely important not only for constructing the first versions of their products but also for creating something easy to maintain and scale. All of this was only possible with the right management tools and personnel.

\ Nowadays, there are essential technologies available for building an MVP. Below, I’ve listed some that are frequently used for web-focused MVPs:

\

React.js or Vue.js: Popular JavaScript frameworks for creating interactive and responsive user interfaces.

Node.js: A fast and scalable JavaScript backend platform suitable for building RESTful APIs.

MongoDB: A flexible and scalable NoSQL database, suitable for MVPs where the data structure can evolve quickly.

\

Additionally, you can use existing management methodologies and tools, such as Scrum, XP, and Design Sprint. To understand how the choice of technology—and any changes to it during business execution—can impact its value, I recommend reading the following article: ‘On Brex: My Thoughts on Backdrop Powers that Chose Kotlin over Elixir’. This article discusses how changing the backend of a company focused on the financial sector can impact its development and investment potential.

\

\ \ Conclusion

Securing investors for an idea is no easy task; it's not as simple as having a "lightbulb moment" like we often see in movies or dramatizations. In reality, it requires a lot of effort and planning to build something that can benefit both the people involved and others. The important thing is to stick to the execution and the initial plan, adopting technologies that will allow you to achieve these three key factors: Scalability, Viability, and Replicability.

This content originally appeared on HackerNoon and was authored by 1uc4sm4theus

1uc4sm4theus | Sciencx (2024-10-03T11:32:33+00:00) Venture Capital Insights: What Investors Look for in Startups. Retrieved from https://www.scien.cx/2024/10/03/venture-capital-insights-what-investors-look-for-in-startups/

Please log in to upload a file.

There are no updates yet.

Click the Upload button above to add an update.